Employee Benefits Insights

Take a New Approach to Savings With Reference-Based Pricing

JULY 5, 2022

As inflation continues to drive up costs, and another recession is likely, offering competitive, cost-effective health benefits will continue to be a challenge for many employers. Organizations seeking to reduce healthcare costs and provide attractive benefits may need to look beyond traditional health plan offerings.

Reference-based pricing (RBP) plans, initially conceived as a way for blue-collar employers to provide basic, low-cost health benefits, could now be worth exploring as part of a broader offering to meet a wide array of employee needs. Unlike a traditional PPO, where the insurance company uses a top-down pricing method to set the rates, RBP vendors price from the bottom up, typically using the Medicare reimbursement rate as a benchmark.

Offering providers 120% to 170% of the Medicare rate often results in much lower healthcare costs — and helps to insulate RBP plans against inflationary pressures and rising costs. To see how traditional and RBP pricing models compare, read Reference-Based Pricing: Is It Right for Your Organization?.

Working with client organizations, USI Insurance Services is designing next-generation RBP plans that incorporate:

- Prenegotiation of claims

- Direct network contracting

- Dual-option plan designs

These added features have helped overcome some initial skepticism of RBP plans from employers and providers alike.

Insurers are also warming up to RBP as a valid benefits model. For example, stop-loss insurers, which provide coverage for catastrophic claims, are starting to see the full value of the savings created with an RBP plan, and are now more willing to price these plans at a discount. When thoughtfully presented, employees may also be more receptive to a lower-cost RBP offering.

Employees Want Options

Providing a range of benefit offerings, including a low-cost alternative, can be a key part of your recruitment and retention strategy. Employees prefer a range of options when selecting the benefits plan best suited for their needs. When RBP plans fail, it’s often because employers are offering it as the only option.

Instead of replacing the entire health plan, giving employees a choice between a traditional health plan or a competitively priced RBP can still generate savings. Employers that experience a significant reduction in the cost of care or increased utilization of the lower-cost plan could even consider offering RBP at no or low-cost to employees.

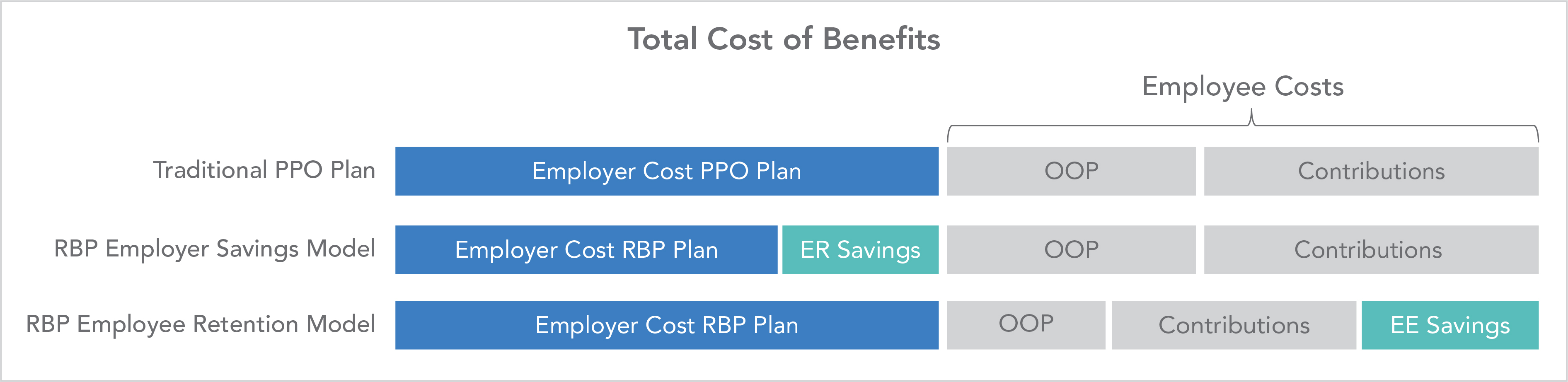

In the above example, the employer (“ER”) cost for one individual plan is $10,000 per employee, per year (PEPY). Employee (“EE”) contributions are $2,500 per year, with an additional $1,500 in out-of-pocket (“OOP”) expenses (e.g., deductibles, copays, etc.). The total cost for the plan is $14,000 PEPY.

Under an RBP employer savings model, plans offered the employer savings of approximately 20%, while the employee out-of-pocket and contributions remained the same. But when used as an employee retention model, the employer cost remains the same while employee contributions and out-of-pocket expenses can be cut in half. For many employees, access to low-cost benefits could be the reason to join or stay with an organization.

How USI Can Help

USI can help employers determine whether offering an RBP plan makes sense for their organization by providing a side-by-side comparison of the current or traditional offering and an RBP plan, and best practices for success.

Employers interested in learning more about RBP can complete USI’s interactive questionnaire to assess the organization’s (and employees’) readiness for an RBP plan. If RBP seems like a good fit, USI further assists employers in evaluating and preemptively addressing compliance issues that may arise. Employers that can successfully implement an RBP plan could potentially save more than 30% on the cost of health benefits.

To learn more about the advantages of offering an RBP plan, and other cost-containment strategies, contact your local USI benefits consultant or email ebsolutions@usi.com.

SUBSCRIBE

Get USI insights delivered to your inbox monthly.