Property & Casualty Insights

Targeted Risk Control for Commercial Vehicles

MARCH 7, 2023

Increasingly frequent and severe losses continue to raise the cost of premiums for commercial auto liability insurance, regardless of industry, location and fleet size. Premiums remained high in 2021 at 8.6 cents per mile, and the cost for motor carriers in general has jumped to its highest level in the last 15 years.1 Insurers have also increased deductibles and lowered excess coverage limits, creating more exposure to liability and driving up the total cost of risk for many insureds.

However, you can combat this costly trend with targeted risk control. USI has found that reducing the frequency and severity of claims can help lower premiums and actual claim dollars by up to 30%.

Understand Your Loss Trends

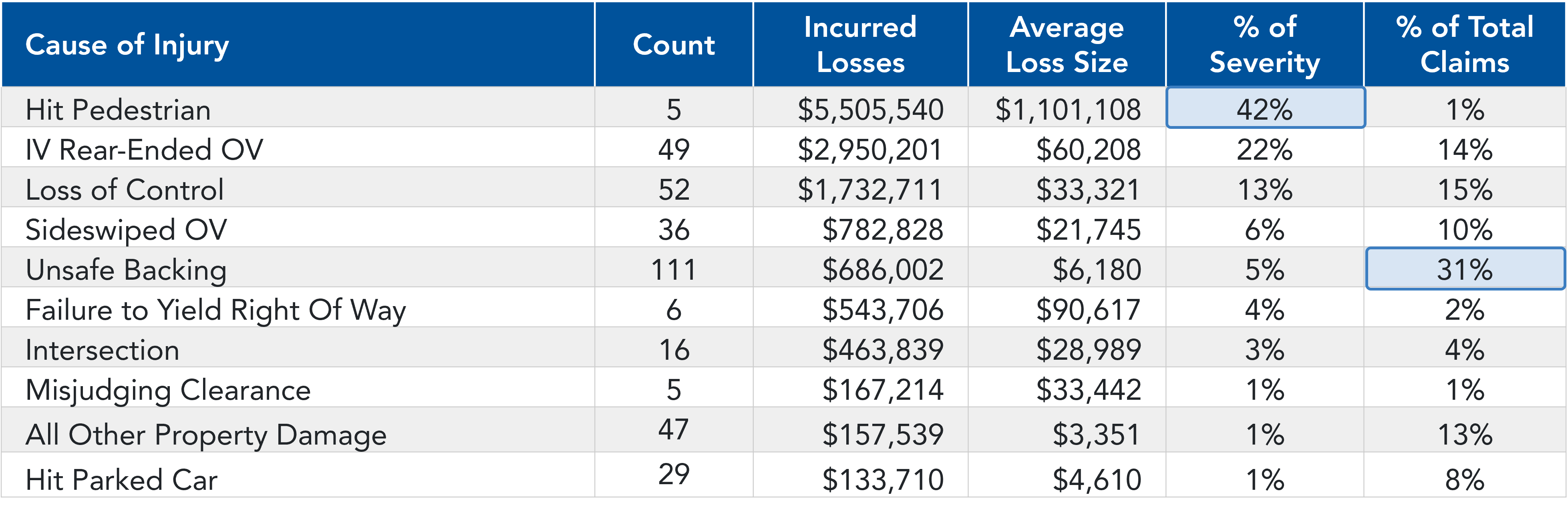

The first step in bending the claim curve in a favorable direction is to conduct a forensic review of your loss history to identify specific loss trends. In this example, the analysis reveals that “unsafe backing” is the leading cause of loss, accounting for 31% of claim frequency:

The review also shows that the most costly crashes – hitting pedestrians – happened five times (1% of total claims), cost over $5.5 million, and accounted for 42% of claim severity. This detailed analysis enables risk control consultants to focus on these key cost drivers and root causes when completing a comprehensive risk inspection of an organization’s operations and safety procedures.

Implement Targeted Solutions

- Reduce disengaged and distracted driving. This problem is a factor in 8.5% of all fatal crashes, and 20% of all crashes.2 With the increased utilization of in-cab technology, companies need to address these new exposures via training and education. Your broker should have an action plan for solving this issue with risk identification, analysis, and other solutions.

- Improve less-than-satisfactory DOT ratings. Poor Department of Transportation (DOT) ratings can result in loss of operating privileges, challenges with securing affordable insurance, loss of customer contracts and increased claim settlement costs. An effective insurance broker can help evaluate on-site investigation reports to determine deficiencies and violations discovered; develop a corrective action strategy to improve compliance and reduce violations; and assist in the preparation of a safety management plan required to increase safety rating.

- Develop driver qualification standards. Companies employing or utilizing drivers as part of their business model need to develop driver qualification standards. Failure to implement appropriate controls can result in higher crash frequency, increased settlement values and recruiting/retention constraints. It’s crucial to evaluate several factors, such as insurance company underwriting guidelines and types of vehicles/equipment, before constructing and implementing standards.

- Improve high Federal Motor Carrier Safety Administration (FMCSA) BASIC scores. When a DOT-regulated organization falls into the Behavior Analysis and Safety Improvement Category (BASIC), or is in alert status, the company may be experiencing operational disruption, increased crashes, higher insurance premiums, and/or decreased driver recruiting and retention efforts. There are specific steps you can take to manage this regulatory risk using detailed analyses, assessments and surveys.

- Design a fleet safety program. This plays an essential role in preventing vehicle accidents and employee injuries, as well as mitigating the financial impact of a hard insurance market. An effective program starts with a comprehensive risk analysis for root causes of fleet losses, potential exposures and existing program shortfalls.

- Improve defensibility in crash litigation. The top ten verdicts for large truck crashes ranged from $12.5 million to $1 billion in 2021.3 Such a substantial financial exposure for fleet operations is mainly due to continued large verdicts, disparity in state laws, and social inflation – the rising cost of insurance claims above and beyond the overall rate of inflation. Protect your bottom line by identifying exposures that could lead to large verdicts and settlements. Begin with a gap analysis that measures current safety policies, procedures, training, documentation and record retention against requirements in these areas.

How USI Can Help

Risk control consultants at USI Insurance Services work with clients to assess exposures to risk and provide prioritized recommendations to improve fleet safety, prevent vehicle accidents and reduce overall loss. USI’s risk control consultants recently assisted a manufacturer with a large fleet of commercial vehicles in developing a fleet safety plan to help reduce the frequency and severity of auto claims. We made several recommendations, including installing a telematics system in all vehicles.

As a result, the client was able to reduce aggressive driving by half, exceeding the speed limit by 89%, and high-speed travel (over 70 mph) by nearly 100%. The reduction in unsafe driving behaviors helped the client reduce accident frequency by 52% and cut claims costs by 61% in the first year after implementation, resulting in premiums 10% below industry average.

Reduce the frequency and severity of accidents and claims, and mitigate associated costs from workplace injuries, litigation and regulatory assessment. Contact your USI representative or email pcinquiries@usi.com to learn more about our fleet safety and other solutions designed to lower your organization’s total cost of risk.

Sources:

1 American Transportation Research Institute, An Analysis of the Operational Costs of Trucking: 2022 Update

2 National Highway Traffic Safety Administration (NHTSA)

3 CaseMetrix

SUBSCRIBE

Get USI insights delivered to your inbox monthly.