Property & Casualty Insights

Navigating Risk Financing: Strategies for Optimizing Cost, Control and Cash Flow

FEBRUARY 6, 2023

With today’s business and insurance challenges, managing risk is a critical task that demands strategic attention. General liability, workers’ compensation and automobile liability are key areas where companies face potential financial exposure. Below, we explore the intricacies of risk financing, and discuss programs that mitigate costs, ensure control, and offer cash flow benefits.

The Impact of Rising Insurance Costs

Rising insurance costs can have significant implications for risk financing. Higher insurance premiums directly contribute to increased operational costs for businesses. This can affect overall financial planning and budgeting, requiring organizations to allocate more resources to cover insurance expenses.

Organizations may find it challenging to allocate sufficient funds for risk management. This could lead to budget constraints, making it difficult to invest in other areas of the business. As a result, organizations might choose to retain more risk and explore alternative risk transfer mechanisms.

Guaranteed Cost Versus Loss-Sensitive Programs

The conventional approach of relying solely on guaranteed cost programs may no longer be sustainable, prompting organizations to seek alternatives that strike a balance between cost, control and cash-flow benefits.

Guaranteed cost and loss-sensitive insurance programs are two different approaches to managing risk with the following key differences:

- Guaranteed cost programs offer fixed premiums, predictable costs and limited flexibility. The insured knows in advance how much they will pay for insurance, and this cost remains constant throughout the policy period, subject to audit of the exposure base the guaranteed cost premium is based on. The insurance company assumes the risk of covering all losses, regardless of their magnitude. In a hard market, this lack of flexibility may result in higher premiums to account for potential losses.

- Loss-sensitive programs offer variable premiums, retained risk, shared risk and flexibility. Loss-sensitive programs can include dividend programs, deductible programs, incurred loss retro programs, group captive programs and self insurance. In loss-sensitive programs, the insured pays a portion of the loss up to a deductible, which is usually capped with a maximum stop loss. The insurance company provides risk transfer above these levels that often can result in lower premiums in more years than not, compared with a guaranteed cost program. The insured’s ultimate costs may vary based on the actual losses incurred during the policy period and in any given year. While these costs could be higher than a corresponding guaranteed cost program, the potential for this scenario is minimized with an effective risk control and claim management program. Loss-sensitive programs provide more flexibility by allowing premiums to be adjusted based on the performance of the insured’s risk management practices and actual loss experience.

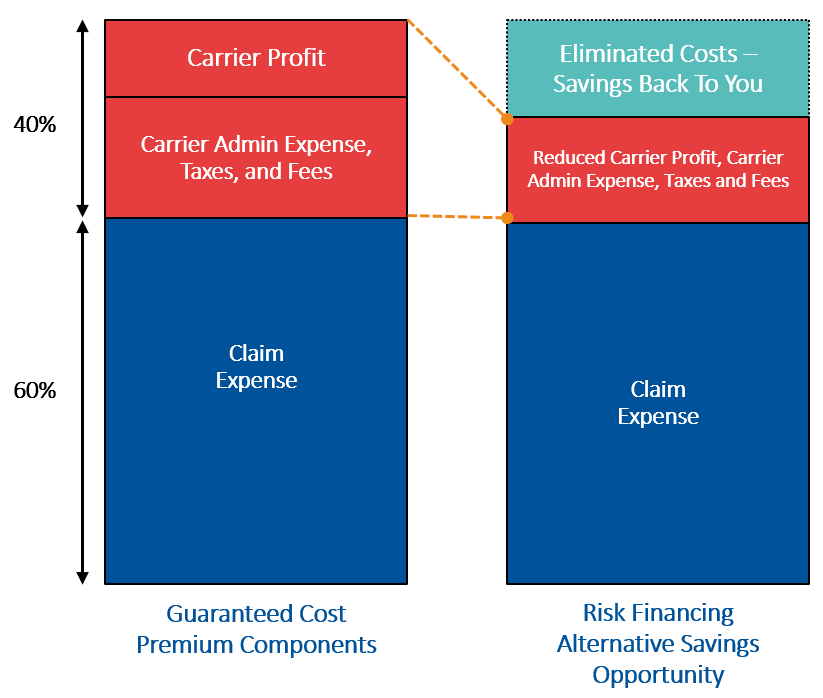

Where Do Savings Come With Risk Financing Alternatives?

In traditional insurance arrangements with a guaranteed cost structure, the premium covers not only the anticipated claims expenses but also the insurance carrier’s administration expenses, taxes and fees. The key characteristic of this arrangement is the predictability and stability of costs, making it easier for businesses to budget for insurance expenses.

On the other hand, risk financing alternatives (such as deductible programs, self insurance, or group captive insurance) offer businesses the opportunity to directly finance a portion of predictable claim expenses.

Savings Example With a Risk Financing Alternative (Workers’ Compensation)

With a well-managed program and loss improvement, USI Insurance Services’ clients have reduced their program costs by 10% to 40% in one year after switching from a guaranteed cost program to a risk financing alternative. The choice between these approaches depends on factors such as the risk tolerance of the business, financial capacity, and desire for greater control over risk management.

In a business environment marked by rising insurance costs and pricing volatility, companies must proactively manage their risk portfolios and how they decide to finance the purchase of insurance. Transitioning from guaranteed cost programs to more tailored risk financing solutions empowers companies to optimize their risk management strategies for long-term success.

How USI Can Help

USI helps clients determine the best financing structure through a detailed analysis of their risk management profile, risk philosophy, and financial position. This process includes risk retention analysis, loss forecasts, variability studies, assessment of existing loss control initiatives, effective claim management programs, and identification of optimal coverage and pricing markets.

To learn more about the various risk financing options for your organization, contact your USI representative or email pcinquiries@usi.com.

SUBSCRIBE

Get USI insights delivered to your inbox monthly.