Property & Casualty Insights

Cash in on Your Loss Control Strategies With Alternative Risk Financing

AUGUST 5, 2025

Many organizations continue to face rising insurance premiums, increased regulatory scrutiny, and evolving risk landscapes for workers’ compensation, auto, and general liability. Recent polls show that over 60% of mid-sized companies are exploring alternative risk financing strategies to gain greater control over their insurance costs. Organizations with proactive loss control programs in loss-sensitive arrangements have seen up to 40% cost reductions.1

Why Loss Control Matters More in Loss-Sensitive Programs

In a guaranteed-cost program, loss control efforts primarily benefit the insurance carrier. The insured pays a fixed premium regardless of actual loss performance, so any reduction in claims translates into higher profits for the insurer. In contrast, loss-sensitive programs encourage both the insurer and the insured to work toward reducing losses by allowing the insured to retain a portion of the risk, creating a shared financial interest in minimizing claims. This means that effective loss control directly reduces the insured’s costs, making loss-sensitive programs more attractive for organizations with strong risk management practices.

Strategic Risk Financing: Unlocking Savings Through Loss Control

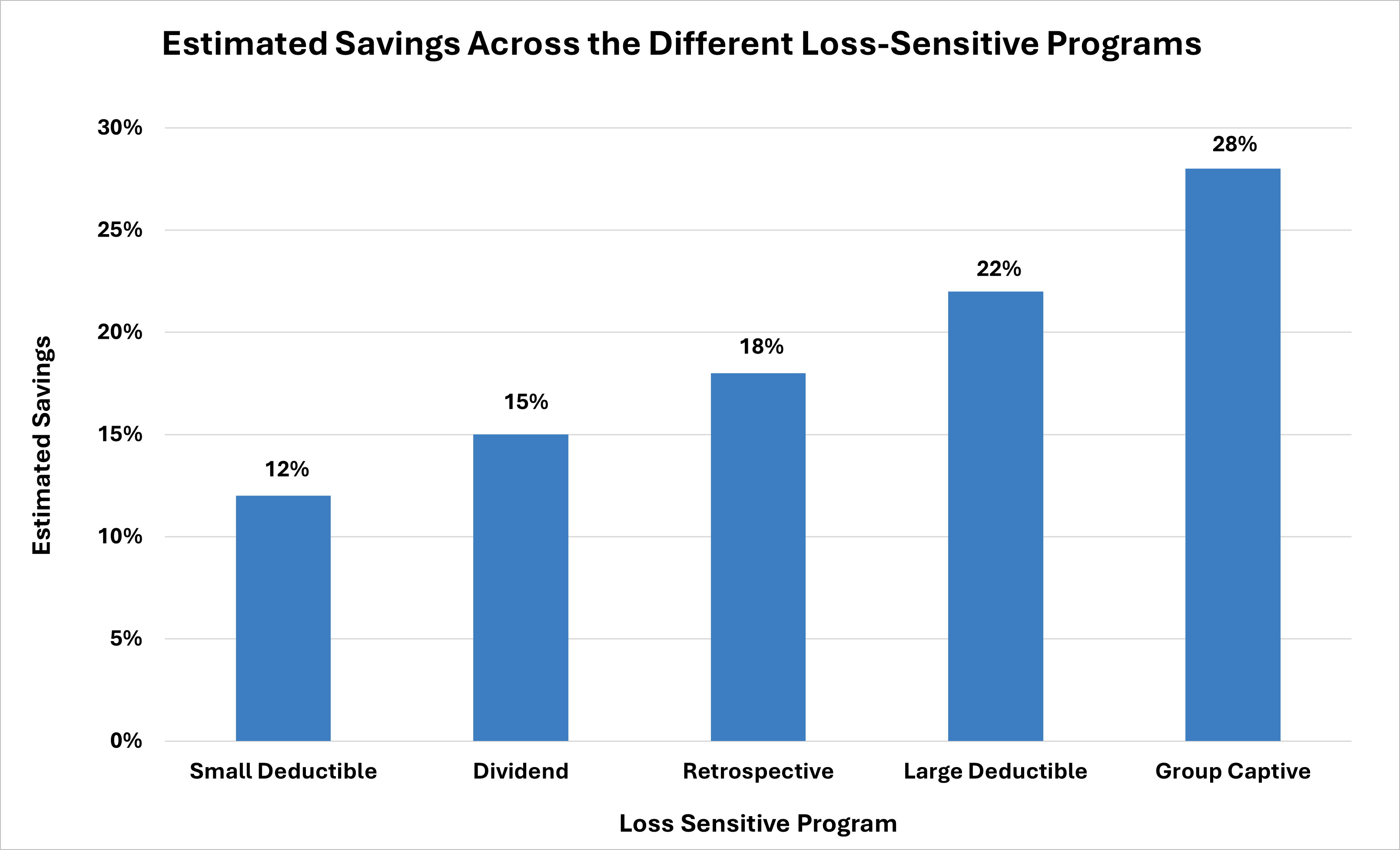

Based on USI’s experience with over 50,000 clients, we have found that organizations on guaranteed-cost programs can reduce their risk financing costs by up to 40% by switching to a more tailored program. Loss-sensitive options such as dividend plans, deductibles, retrospectives, group captives, and self-insured retentions reward effective loss control with lower premiums and greater cash flow flexibility.

How to Identify the Right Risk Financing Strategy

A three-step assessment process can help organizations identify the most effective risk financing strategy.

1. Retrospective Analytics

This step involves a deep dive into your organization’s historical loss data and insurance program performance. The goal is to:

- Identify patterns in claim frequency and severity.

- Compare actual costs under your current guaranteed-cost program versus what they would have been under various loss-sensitive alternatives.

- Evaluate volatility and determine how much risk your organization could have retained without exceeding acceptable thresholds.

2. Forecasting

This step models how different risk financing structures would perform under future loss scenarios. It includes:

- Scenario modeling for best-case, expected, and worst-case loss years.

- Cash flow projections to understand how premium payments and retained losses would affect liquidity.

- Stress testing to assess financial resilience under high-loss conditions.

3. Market Strategy & Placement

Once the optimal risk financing structure is identified, this step focuses on execution:

- Program design tailored to your risk profile and financial goals.

- Carrier negotiations to secure favorable terms, pricing, and coverage.

- Implementation planning, including internal stakeholder alignment and claims management readiness.

Where the Savings Come From

Loss-sensitive programs can reduce costs in several areas:

- Claims expenses (through improved loss control and claims advocacy) that accrue directly to the insured.

- Lower premiums, including carrier profit margins and risk transfer costs as a result of the insured assuming a portion of the risk.

- Improved cash flow and investment income via the insured holding on to loss reserves compared to the insurer.

- Lower premium taxes.

In today’s volatile insurance market, organizations must take control of their risk financing strategies. By leveraging loss-sensitive programs and investing in effective loss control, you can transform insurance from a fixed cost into a strategic advantage.

How USI Can Help

USI helps clients determine the best financing structure through a detailed analysis of their risk management profile, risk philosophy, and financial position. This process includes risk retention analysis, loss forecasts, variability studies, assessment of existing loss control initiatives, effective claim management programs, and identification of optimal coverage and pricing markets. To explore the best options for your business, consult with a risk financing expert and begin your assessment today.

To learn more about the various risk financing options for your organization, contact your USI representative or email pcinquiries@usi.com.

Sources:

1 Global Growth Insights

SUBSCRIBE

Get USI insights delivered to your inbox monthly.