Property & Casualty Insights

Why Pre-Negotiated D&O Liability Terms Matter More Than Ever

NOVEMBER 4, 2025

In today’s high-stakes business climate, small and midsize organizations – including nonprofits – face mounting scrutiny from all sides. Directors and officers (D&Os) are expected to manage complex risks with precision and accountability, yet many remain vulnerable due to inadequate or one-size-fits-all D&O liability coverage.

The Risk Landscape Is Shifting

Recent statistics1 underscore the urgency of robust D&O protection:

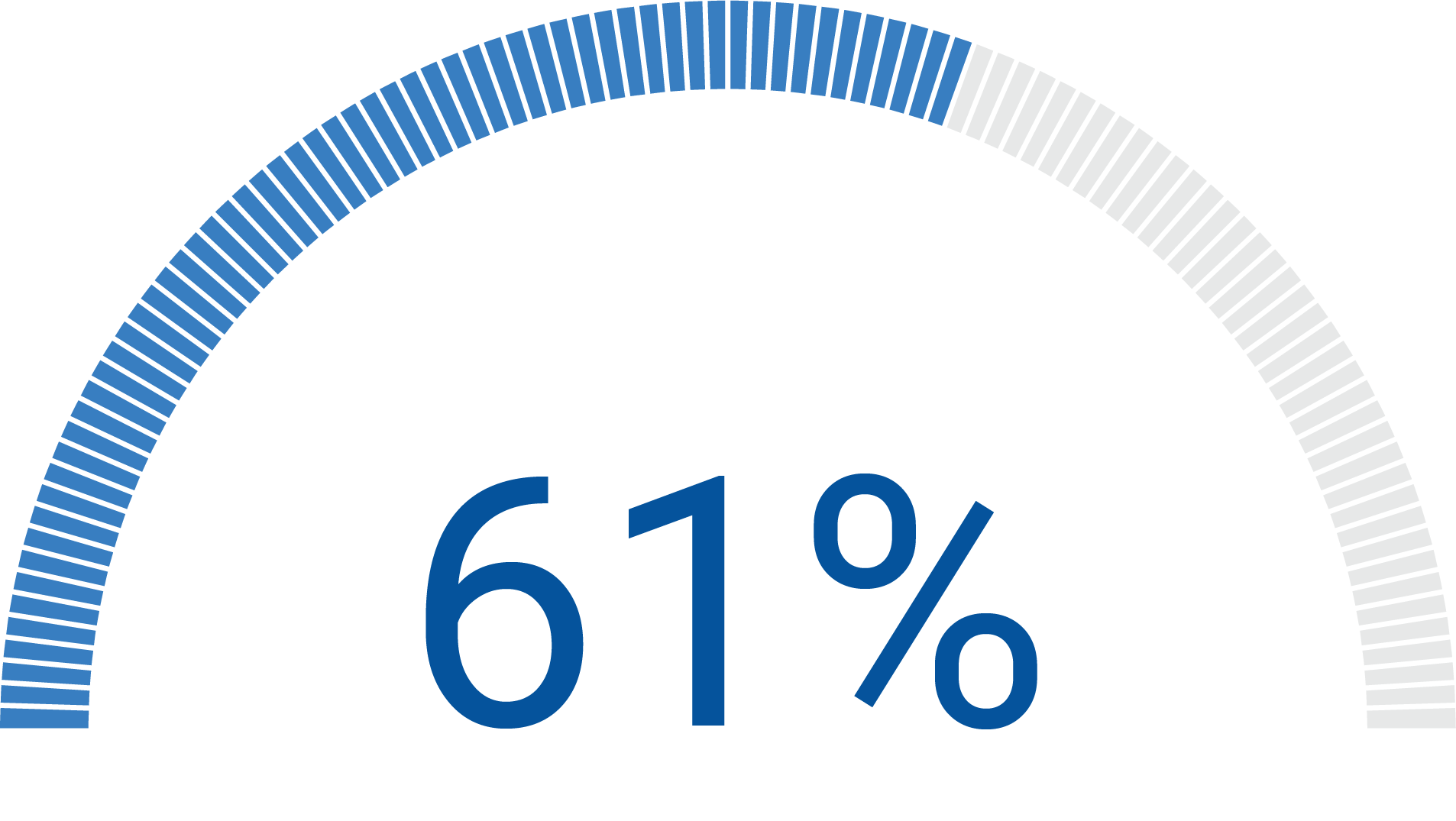

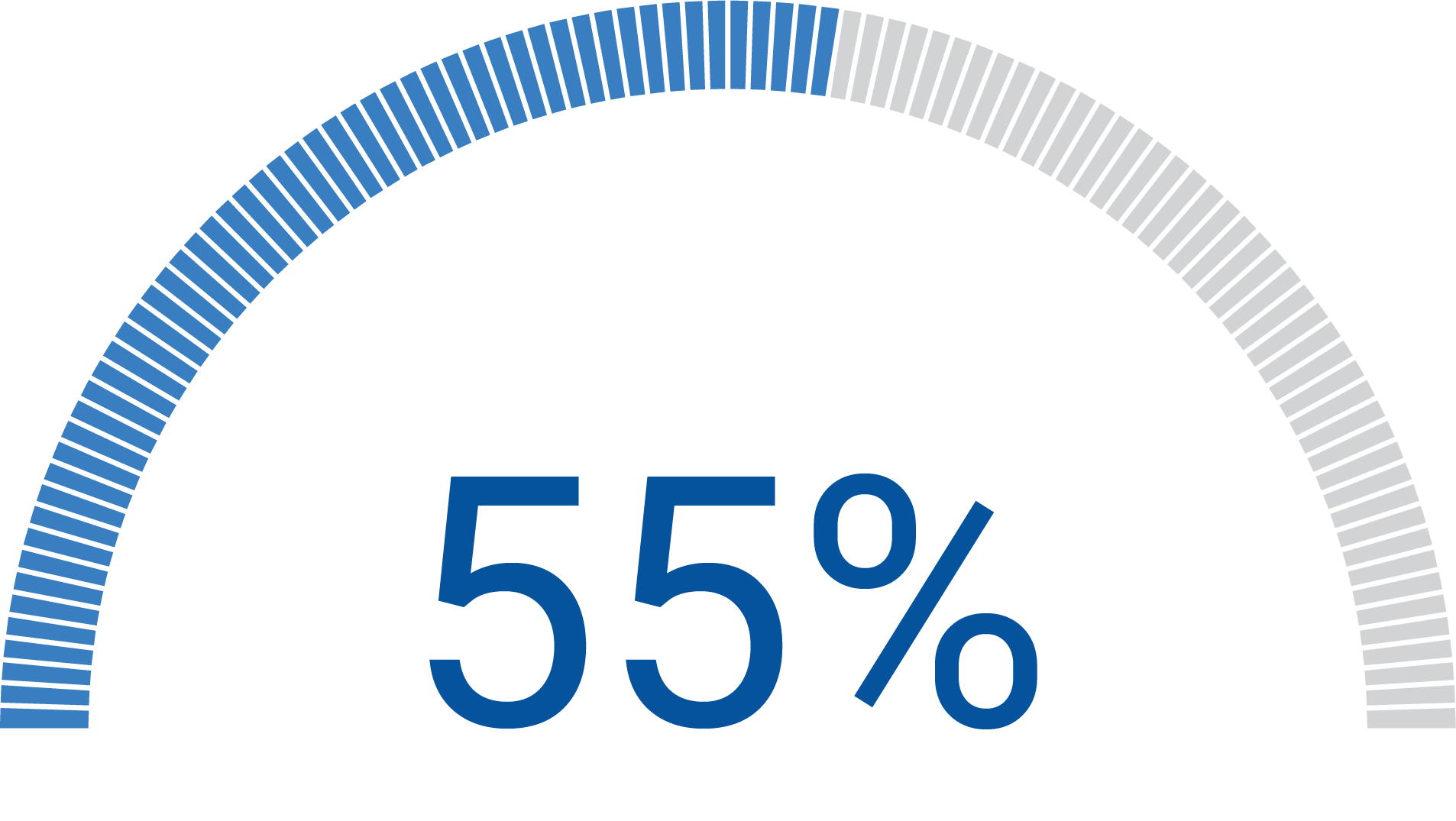

|

|

of professionals report a rise in litigation |

|

|

say courts are increasingly |

These trends are propelled by overall macroeconomic instability, rising bankruptcies (the highest since 2010), increased exposures to cyber threats, and escalating artificial intelligence risks. In particular, firms that are backed by private equity face heightened exposure to alleged failed transactions, misrepresentation claims, and minority shareholder disputes. Therefore, proper D&O liability is a critical frontline defense for any organization’s leadership.

Pre-Negotiated Terms Are a Game-Changer

Many brokers rely on market-standard D&O policies that offer limited flexibility and reactive pricing. To protect themselves, organizations should replace this “off-the-shelf” coverage with enhanced and tailored insurance protection. USI’s proprietary ExecuSafe program provides pre-negotiated terms and conditions for D&O coverage from top-rated, financially stable insurers — creating a clear advantage over standard market policies.

We pre-negotiate critical terms, such as additional, dedicated Side A coverage (for D&Os when the employer can’t indemnify them) and broad protection for individual insureds. This often includes guarantees like coverage that cannot be rescinded, as well as restrictions on exclusions related to antitrust, pollution, professional services, and insured vs. insured claims. Other features include employed lawyers’ coverage to protect in-house attorneys, and a pre-set extended reporting period (“tail” or “runoff”) that allows the insured to report claims after the policy expires, as long as those claims stem from events that occurred during the active policy period. This proactive strategy can save clients hundreds of thousands of dollars and mitigate uncertainty during unpredictable periods.

More Than D&O Coverage

USI’s ExecuSafe solution also extends proprietary coverage to:

- Employment practices liability for claims alleging employment-related wrongful acts like discrimination, harassment, and retaliation. Defense costs for wage and hour violations are also available automatically.

- Fiduciary liability for alleged violations of the Employee Retirement Income Security Act (ERISA) and excessive fee claims.

- Crimes like employee theft, computer fraud, and social engineering (fraudulently induced) losses.

- Kidnap and ransom (K&R) events where financial losses and the need for critical support services are needed.

Enhancements to coverage for all these areas of risk are not typically available through standard market offerings. This reflects USI’s commitment to delivering strategic value — not just insurance.

Case Study: How USI’s ExecuSafe Program Delivers Superior D&O Protection

A private company turned to USI to overhaul its D&O insurance, which was overpriced and contained broad exclusions — leaving critical gaps in coverage. Through our ExecuSafe program, USI closed those gaps with targeted enhancements, including:

- Narrowed fraud/conduct exclusion – USI’s enhancement ensured that coverage for defense costs would remain in place for both the company and alleged wrongdoers until the case was adjudicated or settled. This was financially significant, as defense costs for private or not-for-profit organizations can inflate to hundreds of thousands of dollars, according to leading insurers.

- Narrowed pollution exclusion – This enhancement limited the pollution exclusion to the company only, preserving coverage for any D&Os who may be named in the litigation. As average D&O losses for privately held companies can reach almost $400,000, this protection was essential.

- A higher limit for Side A coverage – USI secured $1 million in added Side A loss protection (up from $500,000).

- Flexibility in settling a contentious EPL claim – This enhancement limited the insurer’s ability to impose significant co-insurance on the insured in the event that the company wished to continue defending a claim after a settlement was agreeable to the claimant and the insurer.

Return on investment (ROI) summary:

| Feature | Impact | Description |

| Improved coverage terms | Up to $900,000 in added protection | An additional $500,000 in Side A protection, plus an elimination of coverage restrictions that could impede a typical loss (approximately $400,000) |

| Premium savings | $10,000 | Securing coverage from a competitive, market-leading ExecuSafe insurer |

All ExecuSafe enhancements were provided at 10% below the organization’s existing premium, thanks to USI’s specialization and strong insurer relationships.

How USI Can Help

Navigating today’s evolving risk landscape requires more than generic coverage — it demands foresight, specialization, and strategic execution. USI’s ExecuSafe program delivers exactly that. By leveraging deep market expertise and long-standing insurer relationships, we offer tailored management liability solutions that go beyond standard protections. Whether you're a private or nonprofit organization, USI helps ensure your leadership is protected — so you can focus on driving your mission forward with confidence.

To learn more about USI’s Executive and Professional Risk Management Services and how we can help your organization manage exposure, please contact your USI representative or email pcsolutions@usi.com.

Source:

1 2025 Global Insurance Law Connect

SUBSCRIBE

Get USI insights delivered to your inbox monthly.