Retirement Consulting Insights

Help Employees Guard Retirement Savings Against Market Volatility

MARCH 5, 2024

A recent survey revealed 86% of employees feel increasingly stressed about their finances — and nearly 50% worry about not having enough saved for retirement.1 Workers who frequently fret about covering unexpected car or home repairs, paying off student loans or credit card debt, or saving for retirement may have their financial worries compounded by the market’s current volatility.

Employers can play an important role in alleviating some of that financial stress by adopting investment strategies for the organization’s retirement plan and helping employees reduce the impact of market volatility on their retirement savings.

Protection Starts With Investment Strategy

To create a retirement plan investment strategy that addresses market volatility and reduces risk, employers can:

- Conduct routine portfolio reviews

- Request guidance from experts

- Diversify investments and allocate asset classes

- Establish a long-term investment outlook

USI Consulting Group’s (USICG’s) retirement plan experts provide these services to organizations to help them follow a disciplined approach and diversify their portfolios. Whether the organization offers a retirement savings plan or pension plan, USICG’s investment advisory services can place employers and employees in a better position when the next bear market arises.

Solutions to Combat Market Volatility

Aside from setting a sound investment strategy for retirement plans, USICG suggests organizations take additional steps to help employees lessen the impact of market volatility on their retirement savings.

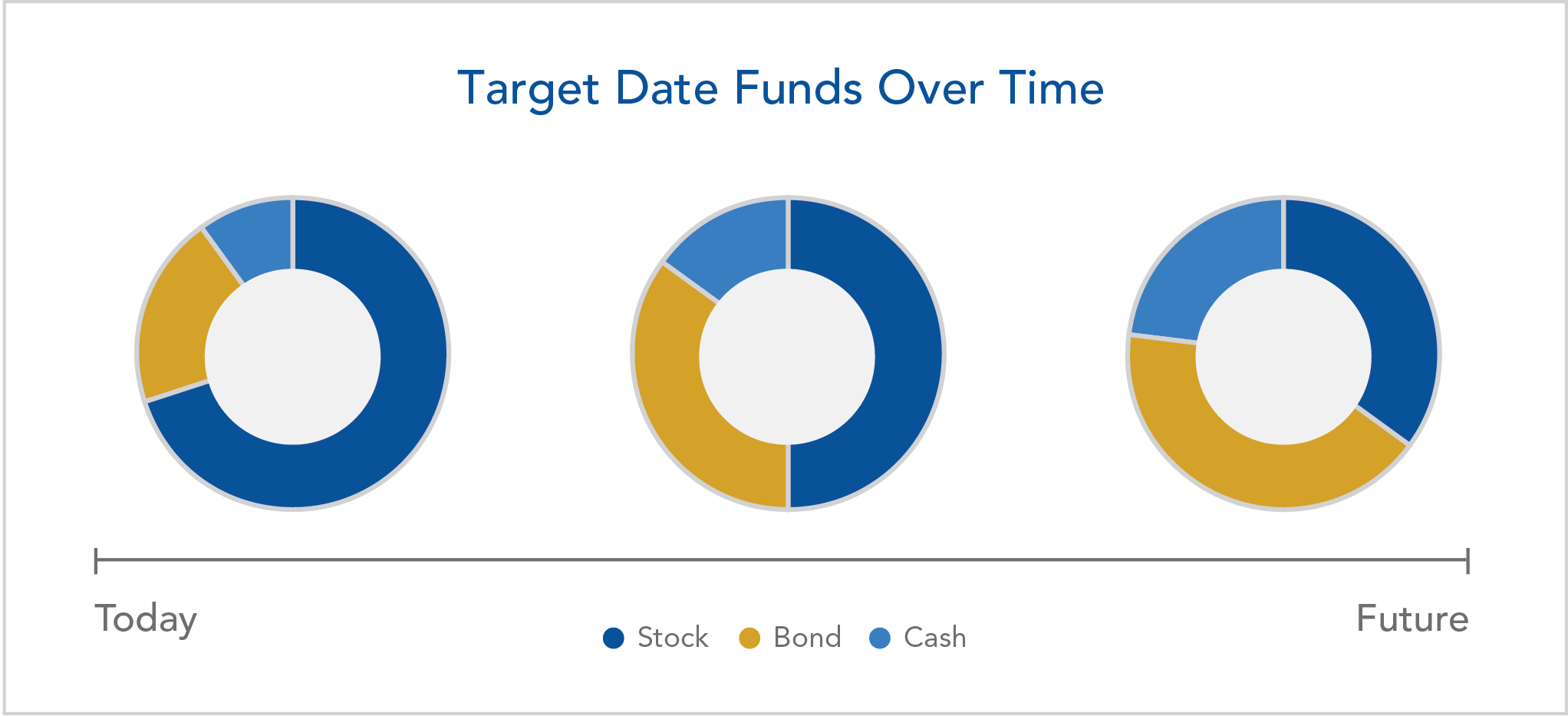

Step 1: Promote the usage of target date funds (TDFs), which provide benefits such as diversification and asset allocation. Retirement plan participants are often invested in TDFs without understanding how they work. Educate your employees about TDFs, explaining how the fund manager diversifies each TDF portfolio by making investments and allocating portions of the total portfolio among three key asset classes (i.e., stocks/equity, bonds/fixed income and cash).

Historically, these asset classes have performed differently over time, and often when one asset class is performing poorly, another may be performing well, thus helping to smooth out any large movement in the value of the portfolio. In addition, research from T. Rowe Price shows retirement plan participants are less likely to make investment changes during periods of market volatility.

Step 2: Provide retirement income planning tools and resources to enhance employees’ understanding of the income they may need when they are no longer working, their sources of retirement income, and how to build savings.

Step 3: Establish emergency cash accounts that allow employees to have automated deposits made through the payroll system. Employees can reach into these accounts when unexpected expenses arise, rather than negatively impacting their retirement savings account by lowering their deferral rate, or taking a loan or hardship withdrawal.

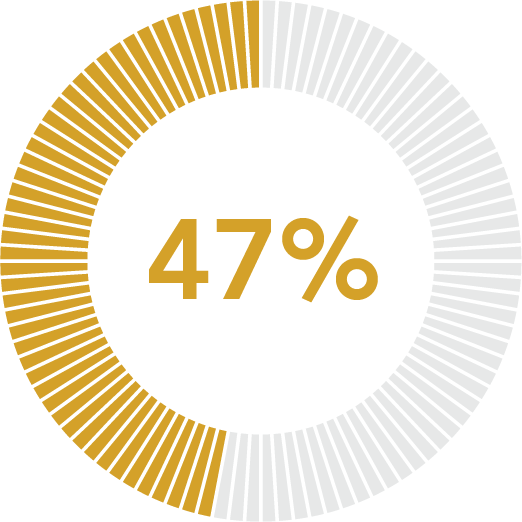

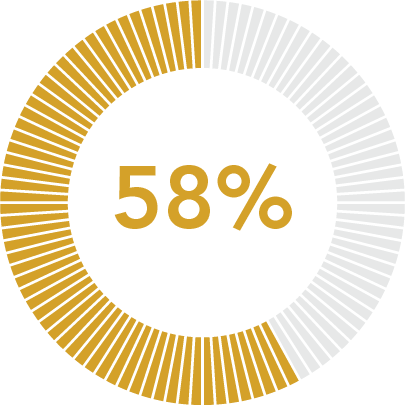

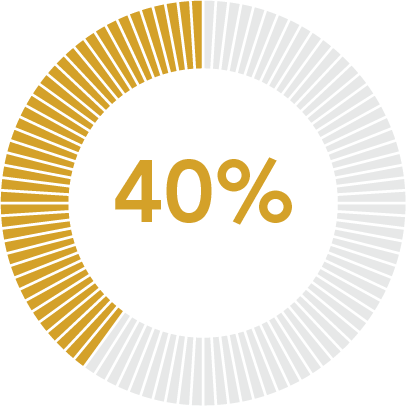

According to two recent surveys, a top priority for nearly half of employees is to have an emergency savings fund — yet 58% of Americans don’t have one, and 40% would use a credit card to pay for an unplanned expense.

|

|

of employees say having an |

|

|

2 out of 3 workers say they’re UNPREPARED |

|

|

of Americans have |

|

|

of Americans would use a CREDIT CARD |

|

Attention pension plan sponsors: If you’ve been contemplating de-risking your pension plan, it may be time to develop a successful pension risk transfer strategy. |

Communicate Options to Employees

USICG recommends employers encourage their employees to:

- Meet with a financial planner and use retirement income planning tools to understand the estimated income needed when they are no longer working.

- Develop a contingency plan of alternative sources of income during retirement (e.g., part-time employment, rental income), or reduce retirement expenses (e.g., downsizing to a less expensive home, fewer vacations).

- Revise timing of retirement. For some older employees, it may be necessary to postpone retirement a couple of years to allow savings to rebuild and market fluctuations to smooth out. Workers who are not approaching retirement age should utilize TDFs, planning tools and other resources to put themselves on track for an on-time retirement.

- Ensure adequate insurance coverage during retirement for healthcare, long-term care and life insurance. Employees need to protect themselves from unexpected medical expenses when they are no longer working. USICG can help optimize benefit plans through comprehensive cost containment, best-in-class pricing, regulatory compliance and superior account service.

Case Study: Reducing the Impact of Market Volatility

A growing law practice wanted to improve its 401(k) experience for plan participants as it grew out of the limited service model of its small, local recordkeeper. First, USICG’s recordkeeper RFP search team helped find a new provider that had dramatically improved technology, a dedicated website and in-person education — providing a better plan participant and plan sponsor experience.

Next, USICG made recommendations to modernize and optimize the investment lineup:

- Establish formal investment fiduciary oversight committee

- Shift to all-zero-revenue-share-generating investment lineup

- Add asset classes to enhance diversification of investment menu

- Include TDFs to provide diversified asset allocation in a single, turnkey investment solution for participants

- Replace bank savings product with stable value manager to improve crediting rate for capital preservation option

The law firm was able to enhance its retirement plan program while providing better risk controls, investment diversification options and ongoing manager due diligence to reduce the impact of market volatility on participants’ long-term savings goals.3

How USI Consulting Group Can Help

While we don’t know what the future holds, you and your employees can take proactive steps to preserve retirement savings over the long term. USICG has extensive experience helping employers evaluate whether asset allocation or investment vehicle changes are necessary. Our team can analyze your situation and develop a customized strategy.

To learn more, please contact your USICG representative, visit our Contact Us page or reach out to us at information@usicg.com.

![]() Follow USICG on LinkedIn to stay up to date with retirement news!

Follow USICG on LinkedIn to stay up to date with retirement news!

Sources:

1 SoFi at Work survey, 2024

2 Lending Tree Emergency Savings Survey, 2023

3 Actual results will vary. The use of any stated benefits in this case study is intended for illustrative purposes only and may not be used to predict or project future results.

Investment advice provided to the Plan by USI Advisors, Inc. Under certain arrangements, securities offered to the Plan through USI Securities, Inc. Member FINRA/SIPC. Both USI Advisors, Inc. and USI Securities, Inc. are affiliates of USI Consulting Group.

This information is provided solely for educational purposes and is not to be construed as investment, legal or tax advice. Prior to acting on this information, we recommend you seek independent advice specific to your situation from a qualified investment/legal/tax professional. | 1024.S0229.0014

SUBSCRIBE

Get USI insights delivered to your inbox monthly.