Retirement Consulting Insights

Help Employees Take Control of Their Finances

MAY 2, 2023

Most U.S. workers are not comfortable admitting they need help with their finances. Day after day, financial stresses can take a toll on physical and mental health. According to the American Psychological Association, chronic financial stress can lead to depression, insomnia, anxiety, heart disease, and diabetes.

To help employees manage stress and health concerns, many organizations sponsor wellness programs that encourage healthy eating, preventive care screenings, exercise, counseling, meditation, and mindfulness. However, programs may not address the causes of stress. Health issues can have a direct impact on your organization’s bottom line through healthcare costs, absenteeism, productivity and delayed retirement.

In a 2020 survey by the Society for Human Resource Management, 80% of employers said financial stress reduces employee performance — totaling nearly $500 billion each year. In addition, workers with financial concerns are 2.3 times more likely to seek a new job.

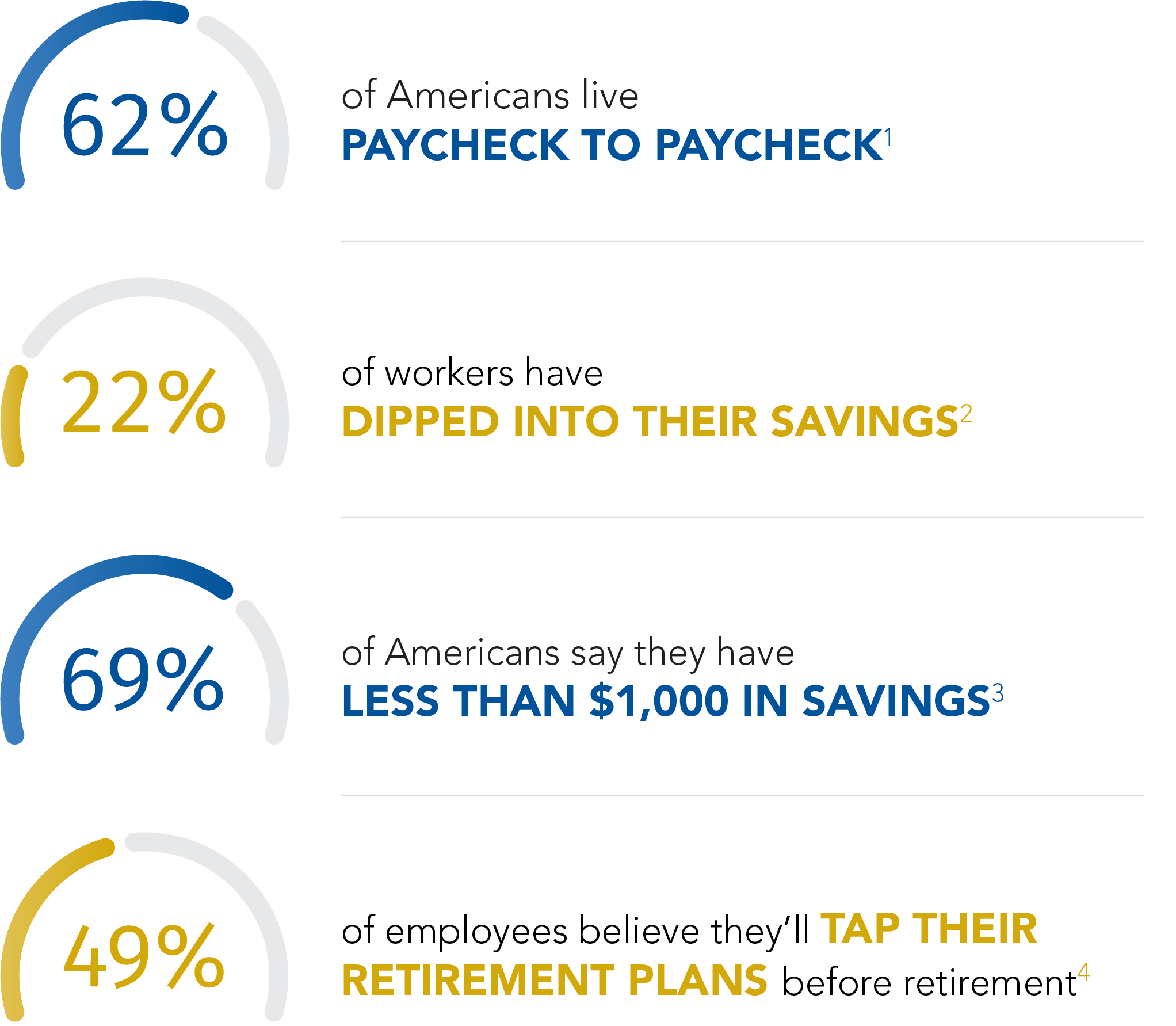

Consider some recent statistics that show how Americans are struggling with their personal finances:

Employees experiencing financial stress need a financial well-being program that does more than offer online retirement income calculators or sessions with investment specialists. Employees need a financial well-being program that helps them improve their ability to live within a budget, reduce debt and save for the future.

Encourage Fiscal Health

Poor financial wellness is a national epidemic, and employees of all ages could benefit from company-sponsored programs that effectively promote financial education and help to prepare them for a financially secure and on-time retirement. Research conducted by Everyday Health indicates 52% of survey respondents are stressed from financial issues, far surpassing the 35% who listed jobs and careers as their primary cause of stress.

Help Employees Take Control of Their Finances & Save More for Their Future

A key component of achieving financial wellness in the workplace is making sure your participants are financially prepared to retire. Employers have begun to focus on employee financial wellness to better understand the barriers employees face in saving for retirement. If employees can’t tackle their short-term goals (i.e., pay down debt, establish emergency savings, afford healthcare), they won’t be able to start thinking about retirement.

Helping employees improve their retirement readiness can also help mitigate the projected economic costs to your business. Each year an employee delays retirement costs an employer more than $50,000 per employee, as reported in our article, “Is Delayed Retirement Impacting Your Bottom Line?” Employers should implement financial wellness programs not only to help their employees now, but also to help workers in the future to achieve the financial freedom to retire. The potential savings to an employer can be millions of dollars.

Achieving financial wellness and retirement readiness depends on workplace benefit offerings. Effectively designing and rolling out a financial wellness program requires setting a strategy; establishing goals and objectives; utilizing data and tools; creating engaging communications; measuring results; and adjusting based on results.

How USI Consulting Group Can Help

USI Consulting Group (USICG) partners with our clients to develop and implement successful financial well-being programs, which can include improving retirement plan participation and increasing deferral rates. Our experts understand how your organization benefits when your employees become financially healthy.

To learn more about USICG’s solutions and how we can help implement a financial well-being program, contact your local USICG representative, visit our Contact Us page, or reach out to us directly at information@usicg.com.

![]() Follow USICG on LinkedIn to stay up to date with retirement news!

Follow USICG on LinkedIn to stay up to date with retirement news!

1 Clever’s COVID-19 Financial Impact Series, September 2020.

2 John Hancock, 2020 Financial Stress Survey.

3 GOBankingRates’ Sixth Annual Savings Survey, 2019.

4 PwC, Employee Financial Wellness Survey, 2021.

This information is provided solely for educational purposes and is not to be construed as investment, legal or tax advice. Prior to acting on this information, we recommend that you seek independent advice specific to your situation from a qualified investment/legal/tax professional.

SUBSCRIBE

Get USI insights delivered to your inbox monthly.