Retirement Consulting Insights

Is Delayed Retirement Impacting Your Organization’s Bottom Line?

MAY 6, 2025

With uncertain economic times, inflation, soaring rates, and record credit card debt, employee financial stress is on the rise. Do your employees struggle to pay off their student loans or credit card debt? Are they achieving short-term financial goals, such as saving for an emergency appliance or car repair?

Research continues to show that Americans are struggling with their personal finances:

|

|

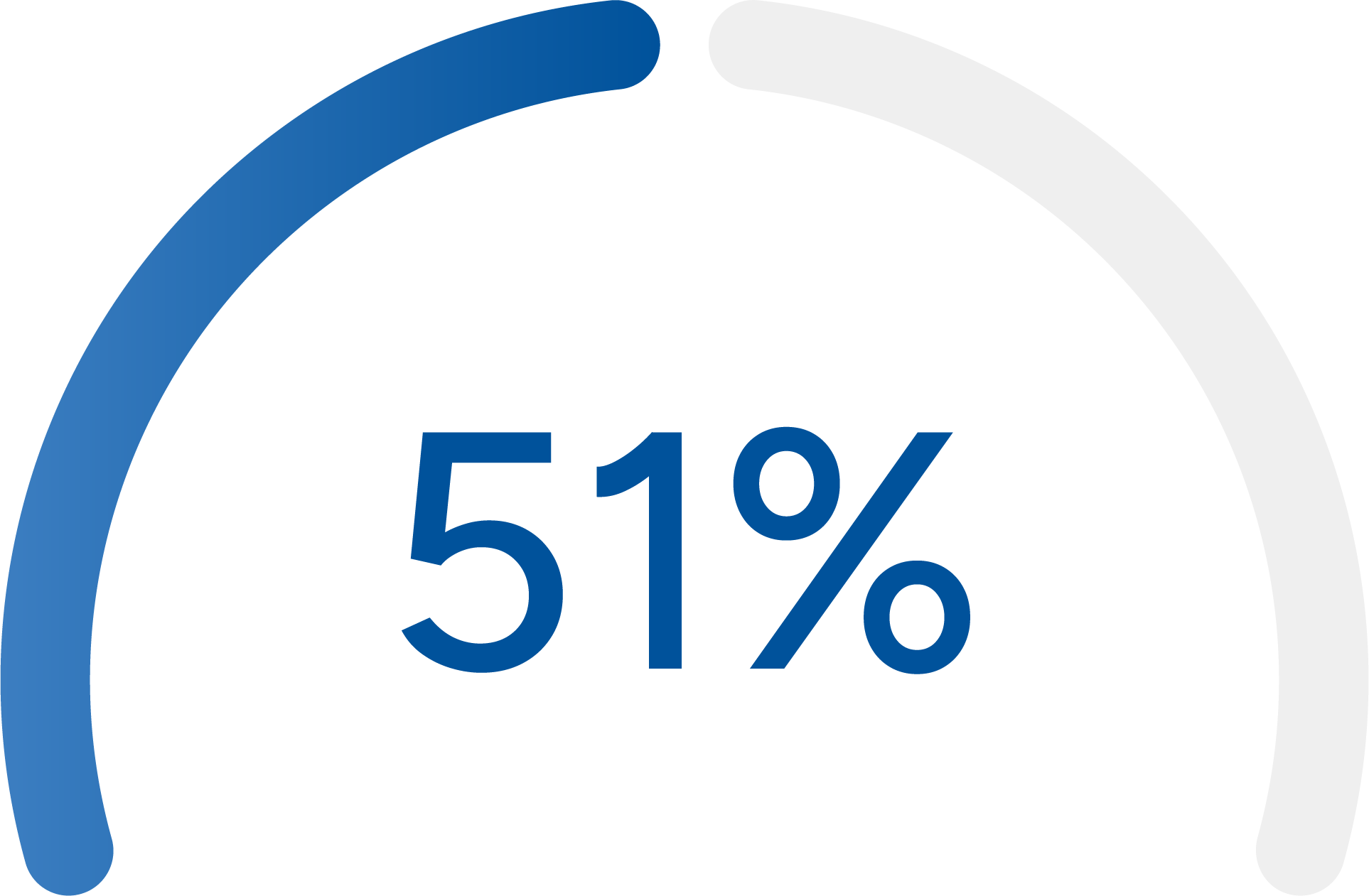

feel “very” or “somewhat” |

|

|

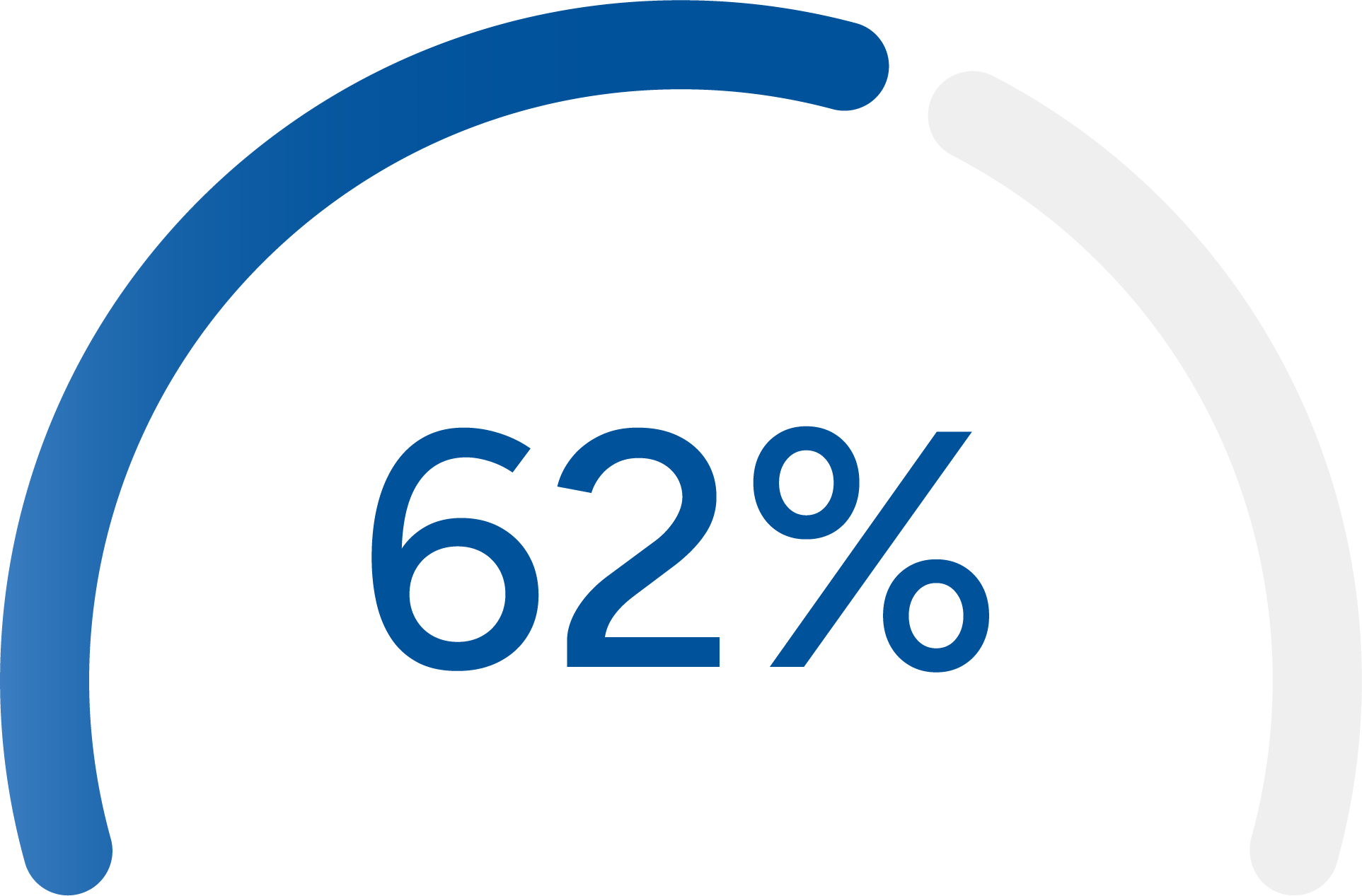

are on track |

|

|

plan to continue |

|

Americans are living longer than ever before — about 30 years longer, on average, than a century ago3 — so the risk of running out of money in retirement is very real. Employers are beginning to understand that the workforce’s financial wellness — or the lack thereof — has a direct impact on the organization’s productivity and bottom line. |

When Workers Are Financially Stressed, Everyone Pays the Price

|

EMPLOYEES |

EMPLOYERS |

||

78% |

live paycheck to paycheck4 |

56% |

of employees spend time on personal finances while at work, decreasing productivity5 |

22% |

have dipped into emergency savings5 |

40% |

of employees expect to postpone retirement, which impacts their employer’s bottom line8 |

1/3 |

have $100 or less in a savings account6 |

2X |

financially stressed employees are 2x more likely to look for a job elsewhere5 |

37% |

have tapped into retirement savings prior |

50% |

replacement cost to an employer is approximately 50% of the employee’s salary9 |

Employee Financial Well-Being Matters to Your Business

Many organizations don’t know how financially prepared their employees are for retirement, or the potential impact on bottom-line results. Employees who are unable to reach short-term financial goals are probably not focused on long-term financial objectives, such as retiring at their goal retirement age. A workforce unprepared to retire can impact a business in a variety of ways, including:

+ |

|

|

Potentially higher labor costs |

+ |

|

|

Increased healthcare premiums |

= |

|

|

Lower productivity |

|

Delayed retirement can have a significant financial impact on your organization. |

Long-Term Costs of Delayed Retirement for Employers

If we take the additional cost of $50,000 per employee per year, we can illustrate the potential long-term impact on your organization. The chart below shows significant expenses whether you have a small or large number of employees.

|

Total additonal cost |

1 year |

3 years |

5 years |

||

| 100-person company with 3 employees delaying retirement |

$150K | $450K | $750K | ||

| 500-person company with 15 employees delaying retirement |

$750K | $2.25M | $3.75M | ||

| 1,000-person company with 30 employees delaying retirement |

$1.5M | $4.5M | $7.5M | ||

| 10,000-person company with 300 employees delaying retirement |

$15M | $45M | $75M | ||

Given the implications, employers feel an even greater responsibility for their employees’ retirement readiness. Approximately 80% feel extremely or very responsible for helping employees prepare for retirement (compared with 22% in 2012). Meanwhile, 83% believe employee financial wellness programs and tools help create a more productive, satisfied and engaged workforce.11

Employer Support Can Help Employees

Achieving financial wellness and retirement readiness starts with the employer, as it’s dependent on workplace benefit offerings. Employers can help improve employees’ retirement readiness by investing in programs that promote financial education and prepare them for a financially secure future. Learn more about the components of a comprehensive strategy to promote retirement readiness.

How USI Consulting Group Can Help

USI Consulting Group (USICG) is ready to work with you to evaluate your organization’s retirement plan and implement strategies to better prepare your employees for retirement and help offset financial impact. We can help you:

- Enhance plan design using our proprietary benchmarking analysis

- Evaluate best fit and fees with a recordkeeper provider search

- Provide ancillary retirement benefits like a Nonqualified Deferred Compensation (NQDC) Plan and/or a Direct Recognition Variable Investment Plan (DR-VIP) to help highly compensated employees save more

- Implement an employee education program to improve financial wellness

For more information, please contact your local USICG representative, visit our Contact Us page, or reach out to us directly at information@usicg.com.

![]() Follow USICG on LinkedIn to stay up to date with retirement news!

Follow USICG on LinkedIn to stay up to date with retirement news!

1 NextAdvisor study, June 2020.

2 Schroders, U.S. Retirement Survey, 2021.

3 In 1900, the average life expectancy was 50 years old. According to the Centers for Disease Control and Prevention, the average life expectancy in the U.S. is 78.6 years old.

4 Payroll.org, Increase in Americans Living Paycheck to Paycheck in Just One Year, 2023.

5 PwC, Employee Financial Wellness Survey, 2023.

6 IGOBankingRates, Annual Savings Survey, 2023.

7 Transamerica Center for Retirement Studies, 2023.

8 8 Nationwide Retirement Institute’s In-Plan Lifetime Income Survey, 2022.

9 G&A Partners, Calculating the Cost of Employee Turnover, 2024.

10 Prudential, Why Employers Should Care About the Costs of Delayed Retirements, 2019.

11 Bank of America, Workplace Benefits Report, 2020.

This information is provided solely for educational purposes and is not to be construed as investment, legal or tax advice. Prior to acting on this information, we recommend that you seek independent advice specific to your situation from a qualified investment/legal/tax professional. | 1024.R0606.99011

SUBSCRIBE

Get USI insights delivered to your inbox monthly.