Retirement Consulting Insights

Best Practices for Maintaining Your Retirement Records

SEPTEMBER 7, 2021

Retirement plan sponsors in the U.S. often ask how long they are required to retain retirement plan and participant records. It is an excellent question that has no easy answer. Because there is no explicit guidance, the answer depends somewhat on the plan sponsor’s tolerance for risk.

Having appropriate record retention policies and practices is essential for a plan sponsor for a few reasons. It allows them to meet their ERISA fiduciary duties, to fulfill their responsibilities in processing claims, to mitigate any problems in IRS or DOL audits, and to avoid protracted disputes with participants, beneficiaries and retirees.

With respect to plan-level record retention, the idea is to retain supporting information and documentation that would permit a plan sponsor to verify and explain plan records to federal agencies, which will confirm the accuracy and completeness of the sponsor’s representations about the plan. With respect to participant-level record retention, the goal is for the plan sponsor to be able to determine the benefits of plan participants. In addition, failure to maintain such participant-level required records for any plan year could result in a civil penalty for each employee affected by the failure.

The primary authority for record retention rules can be found in ERISA Sections 107 (plan-level records) and 209 (participant-level records), as well as in the IRS’s statute of limitations related to audits.

The Bare Minimum: A Moderate Approach to Record Retention

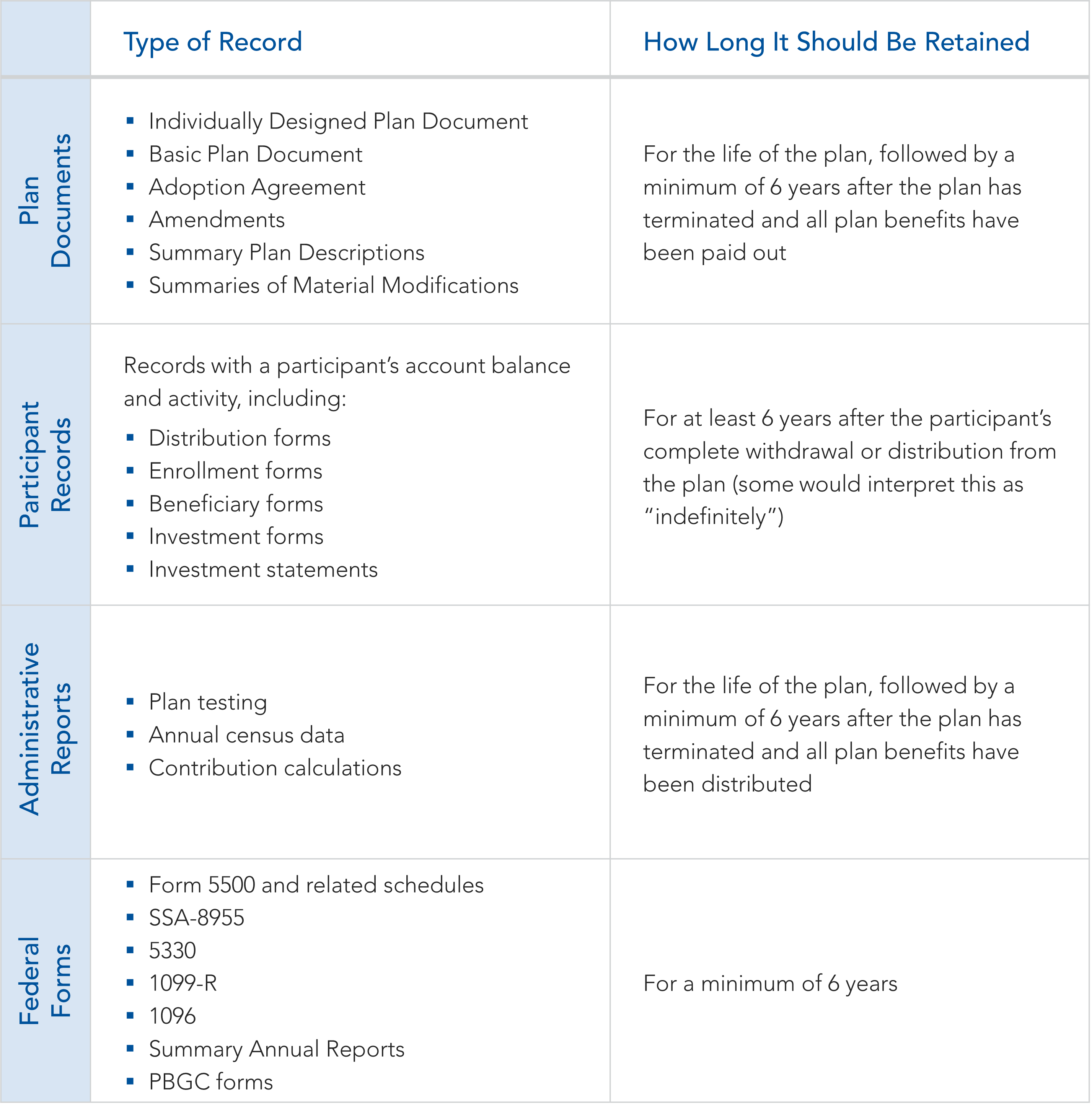

The moderate approach, which is considered the bare minimum period for record retention, is to retain records for at least six years following the termination of the plan, a distribution from the plan, or the filing of federal forms. A moderate approach to record retention would generally look like this:

Highly Recommended: A Conservative Approach to Record Retention

The conservative approach to record retention is to permanently keep executed plan documents, amendments, summary plan descriptions, executed trust agreements, applicable resolutions, determination letter packages, IRS determination letters, and any documentation that requires notarization or a seal.

A conservative approach to participant-level records is highly recommended as a best practice for a simple reason. Very often, a participant will contact a plan sponsor or its third-party administrator and claim that they have no proof they ever received their plan benefits. This can happen decades after the participant took a distribution from the plan, and the participant genuinely cannot recall or find proof of the distribution. The inquiry is frequently the result of a communication from the Social Security Administration that explains to the participant that “you may have retirement benefits due to you.” Having copies of the participant’s distribution records can make it simple to respond to these inquiries, consuming little time and effort.

Electronic Record Retention: The Requirements

Under ERISA, plan sponsors can retain plan and participant records electronically if the retention medium satisfies the following requirements:

- There are reasonable controls to ensure the integrity, accuracy, authenticity and reliability of the records;

- The records are maintained in reasonable order and in a safe, accessible place, and they can be relatively easily inspected or examined;

- The records are relatively easily convertible into a legible and readable paper copy as may be needed to satisfy requirements under Title 1 of ERISA, including reporting and disclosure requirements;

- The recordkeeping system is not subject, in whole or in part, to any agreement that would compromise or limit, directly or indirectly, a person’s ability to comply with requirements under Title 1 of ERISA, including reporting and disclosure requirements; and

- Sufficient records management practices are established and implemented.

How USI Consulting Group Can Help

USI Consulting Group works with plan sponsors to create record retention policies, whether moderate or conservative, as well as procedures to ensure that all individuals or entities responsible for the administration of their plans comply with the policies.

If you have any questions regarding record retention policies and recommendations, please contact your USI Consulting Group representative or email us at information@usicg.com.

SUBSCRIBE

Get USI insights delivered to your inbox monthly.