Retirement Consulting Insights

Take Control of Fiduciary Risk With the Right Support

JULY 1, 2025

Less than 50% of retirement plan sponsors are fully aware of their fiduciary responsibilities under the Employee Retirement Income Security Act (ERISA).1 Investment oversight of retirement plans is a top priority for employers, and fiduciaries must understand their responsibilities and the associated risks. Employers with limited experience and awareness may increase litigation risk.

|

Under ERISA, a plan fiduciary:

|

Lack of Fiduciary Knowledge Can Be Costly

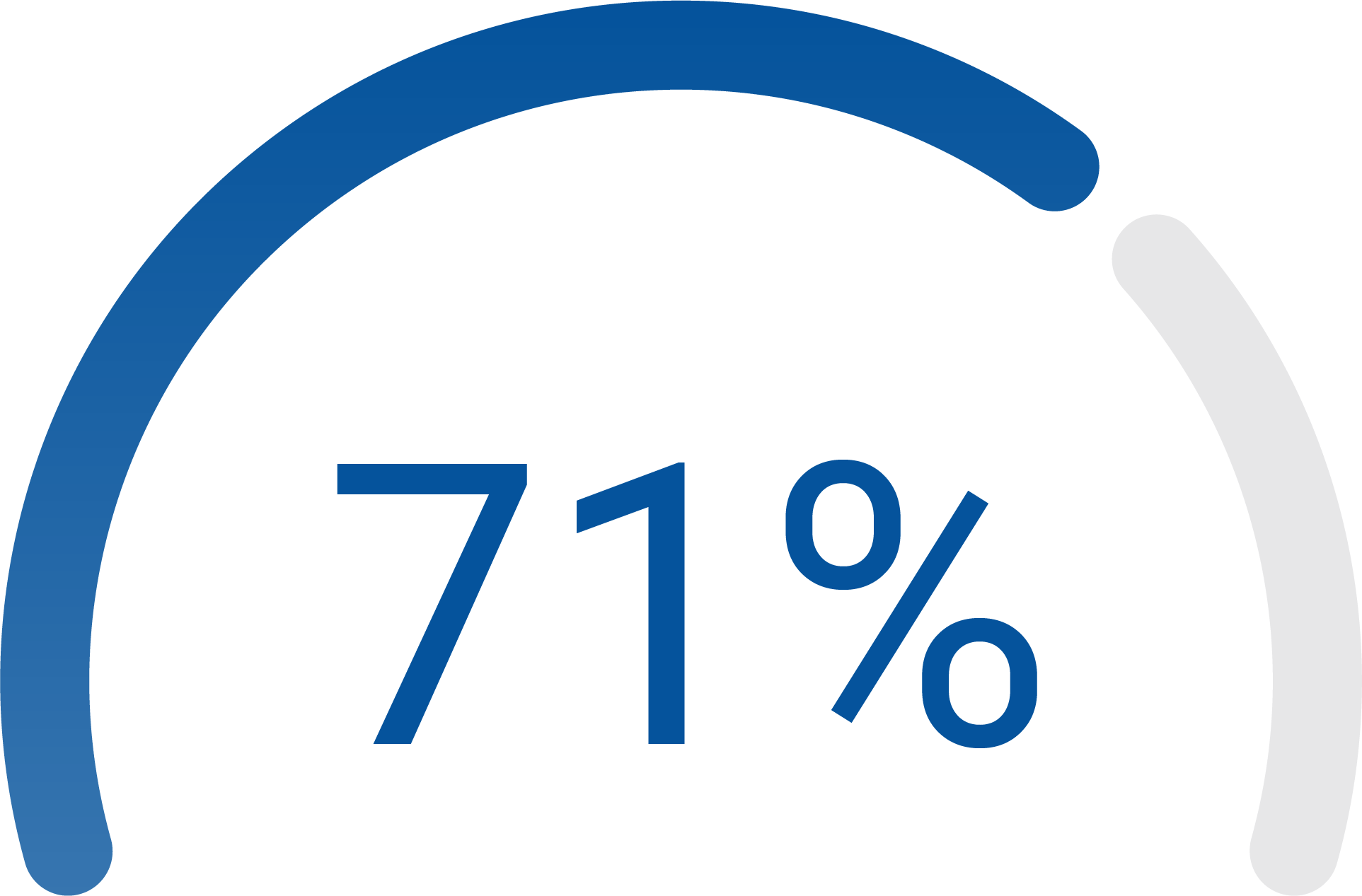

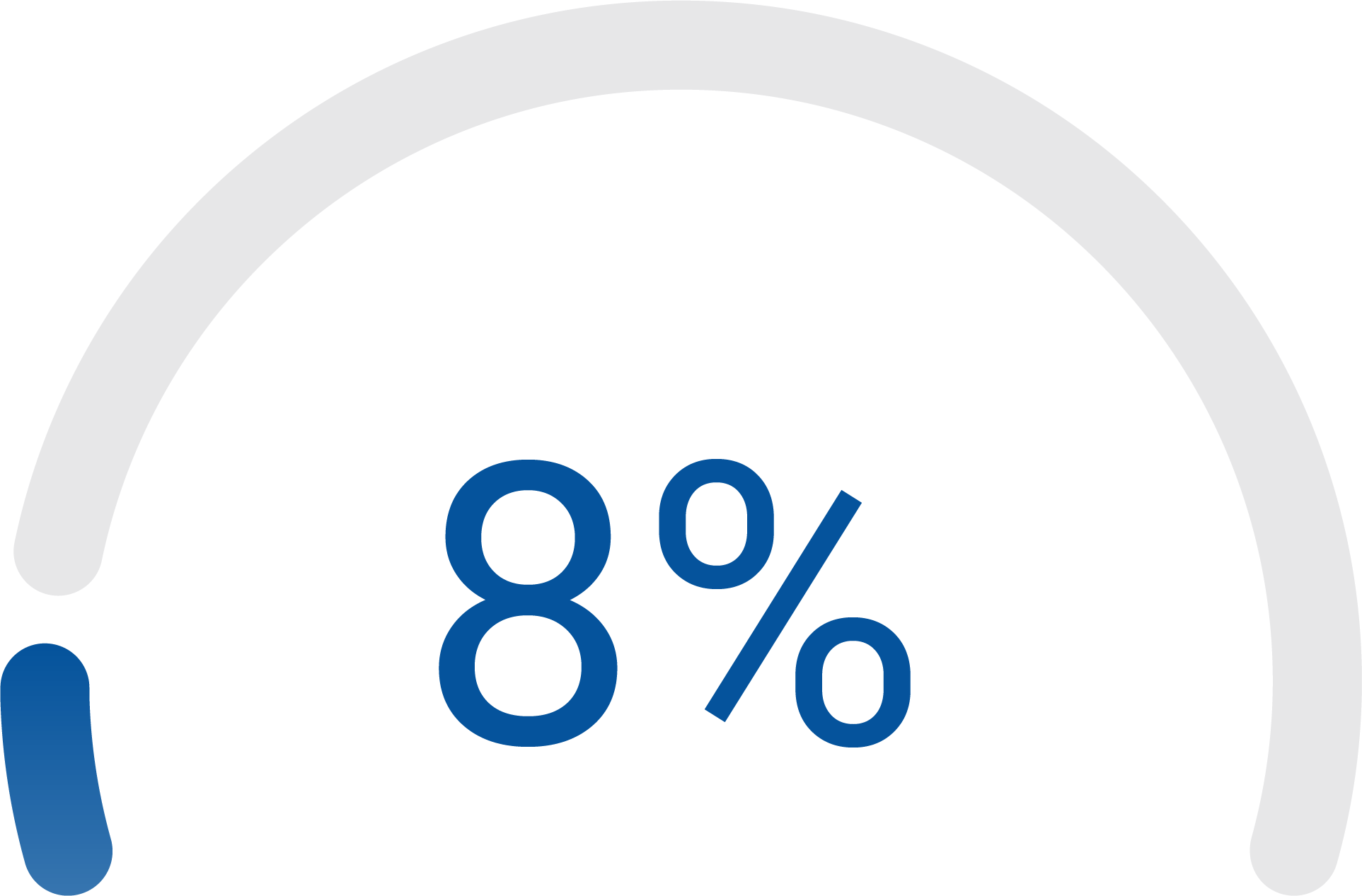

Despite not fully comprehending their fiduciary responsibilities and the related risks, some employers proceed with making decisions and changes that affect their retirement plan’s investments:2

|

|

plan to implement, update or review their investment policy statement |

|

|

plan to evaluate or review their managed account services |

|

|

plan to add or remove specific asset categories |

These employers can be exposed to millions of dollars in litigation risk. In fact, recent studies show insurance companies have paid more than $1 billion in settlements.3

ERISA litigation, particularly class action lawsuits, has increased significantly since 2015 due to excessive fee allegations and concerns about retirement plan investment performance. Notably, ERISA excessive fee class action litigation surged by 35% in 2024.4 Not exercising appropriate fiduciary oversight can have adverse financial impact on participants.

The U.S. Department of Labor’s (DOL’s) list of lawsuits reveals a range of fiduciary errors related to improper investment management and imprudent investment decisions. These errors cost retirement plans millions and reduce benefits for some plan participants.

Fiduciary Support That Fits

You don’t have to shoulder all the responsibility for investment selection or be an investment expert. USI Consulting Group (USICG) helps employers reduce their fiduciary liability by providing enhanced investment oversight and holistic plan governance through ERISA 3(38) or 3(21) service models. USICG offers customized, flexible fiduciary support depending on the employer’s level of involvement.

|

ERISA 3(38) Service Model |

ERISA 3(21) Service Model |

||

|

Investment decisions are made on your behalf by an ERISA 3(38) fiduciary — an investment manager who:

|

You review and approve investment recommendations made by an ERISA 3(21) fiduciary advisor who:

|

||

|

When selecting fiduciary support, consider whether: |

|||

|

|

||

Case Study: Move in the Right Direction With USICG Fiduciary Support

A moving and storage company in the Northeast selected USICG to provide an ERISA 3(38) service model solution after its retirement plan committee struggled to meet consistently and faced challenges with high investment costs.

USICG uncovered deficiencies in the plan governance where the DOL could have levied penalties. The following issues were corrected by USICG:

- Moved the plan to a 3(38) fiduciary model, which reduced fiduciary liability associated with the investment menu from the plan sponsor to the investment manager

- Transitioned from an all-mutual-fund lineup to a collective investment trust (CIT) lineup, reducing investment management expenses from 0.37% to 0.19%

- Expanded the investment menu to include new asset classes while streamlining options to better align with the varying levels of sophistication and risk tolerance among plan participants

- Negotiated lower recordkeeping fees, moving from 0.46% down to 0.30%

- Eliminated a bundled pricing model and moved to a more transparent fee schedule

- Developed a comprehensive retirement plan education and communication strategy for employees

How USI Consulting Group Can Help

USICG helps employers better understand their fiduciary responsibilities and mitigate fiduciary risk. We provide clients with ongoing investment due diligence support, fiduciary training, plan operations and compliance oversight, periodic provider searches, and fee benchmarking and plan design consulting services, whether you select an ERISA 3(21) or 3(38) service model.

To learn more, please contact your USICG representative, visit our Contact Us page, or reach out to us at information@usicg.com.

![]() Follow USICG on LinkedIn to stay up to date with retirement news!

Follow USICG on LinkedIn to stay up to date with retirement news!

1 Pentegra Adviser Study, 2025

2 Callan Institute Defined Contribution Trends Survey, 2023

3 Euclid Specialty Whitepaper: Exposing Excessive Fee Litigation Against America's Defined Contribution Plans, 2020

4 PlanAdviser, 401(k) Excessive Fee Litigation Spiked to ‘Near Record Pace’ in ’24, 2025

Investment advice provided to the Plan by USI Advisors, Inc. Under certain arrangements, securities offered to the Plan through USI Securities, Inc. Member FINRA/SIPC. Both USI Advisors, Inc. and USI Securities, Inc. are affiliates of USI Consulting Group.

This information is provided solely for educational purposes and is not to be construed as investment, legal or tax advice. Prior to acting on this information, we recommend that you seek independent advice specific to your situation from a qualified investment/legal/tax professional. | 1023.S1103.0085

SUBSCRIBE

Get USI insights delivered to your inbox monthly.