Retirement Consulting Insights

Why Bundling Retirement Services Is a Smart Move for Employers

SEPTEMBER 2, 2025

In today’s complex and competitive business environment, employers are under increasing pressure to manage retirement plans efficiently while meeting regulatory demands and employee expectations. For many organizations — especially those managing multiple retirement plans — total retirement outsourcing (TRO) has emerged as a powerful strategy.

TRO consolidates the administration of all qualified and nonqualified retirement plans under a single provider, streamlining operations and enhancing strategic value. From 401(k)s and 403(b)s to pensions and nonqualified plans for highly compensated employees, TRO offers a unified approach that reduces administrative burden, improves compliance, and delivers a better experience for both employers and employees.

|

Why TRO Is Gaining Momentum Retirement plan sponsors continue to shift plan administration to external service providers at a rapid rate. The primary drivers? Cost reduction, improved efficiency and the ability to free up internal resources. As retirement plan complexity grows and fiduciary liability increases, employers are turning to TRO to simplify plan management and gain more value from their benefits investment. |

Key Benefits of Bundling Retirement Services

1. Streamlined Administration

HR departments often spend significant time on routine retirement plan tasks, such as processing paperwork, answering participant questions and maintaining data. TRO providers take over these responsibilities, allowing HR teams to focus on strategic initiatives.

Advanced technology platforms used in TRO offer:

- A single payroll feed for accurate, up-to-date participant records across all plans

- Consolidated reporting for a holistic view of plan performance and compliance

- Integrated nondiscrimination testing and benefit application processes

- Real-time workflow management for internal tasks and communications

2. Simplified Vendor Management

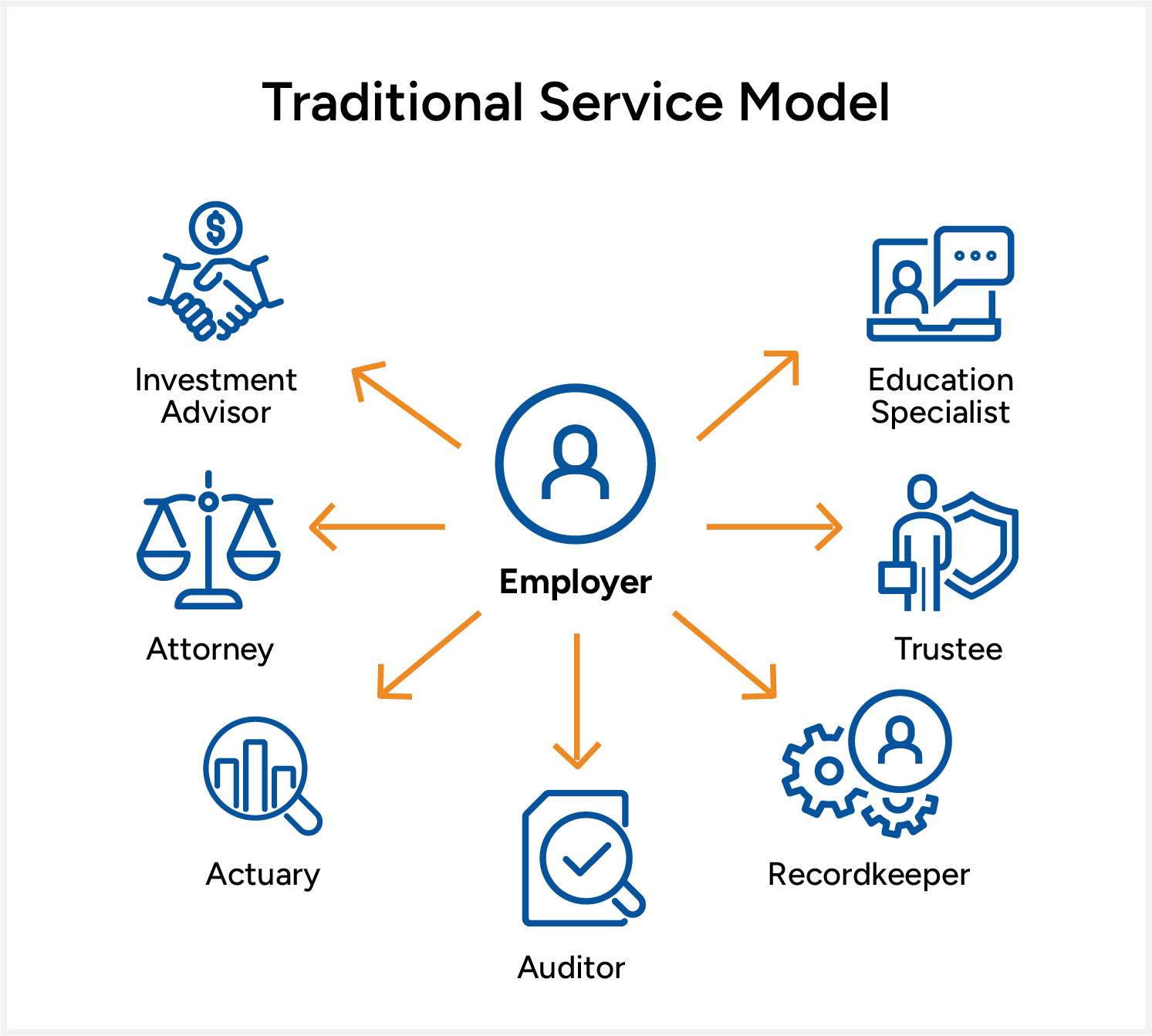

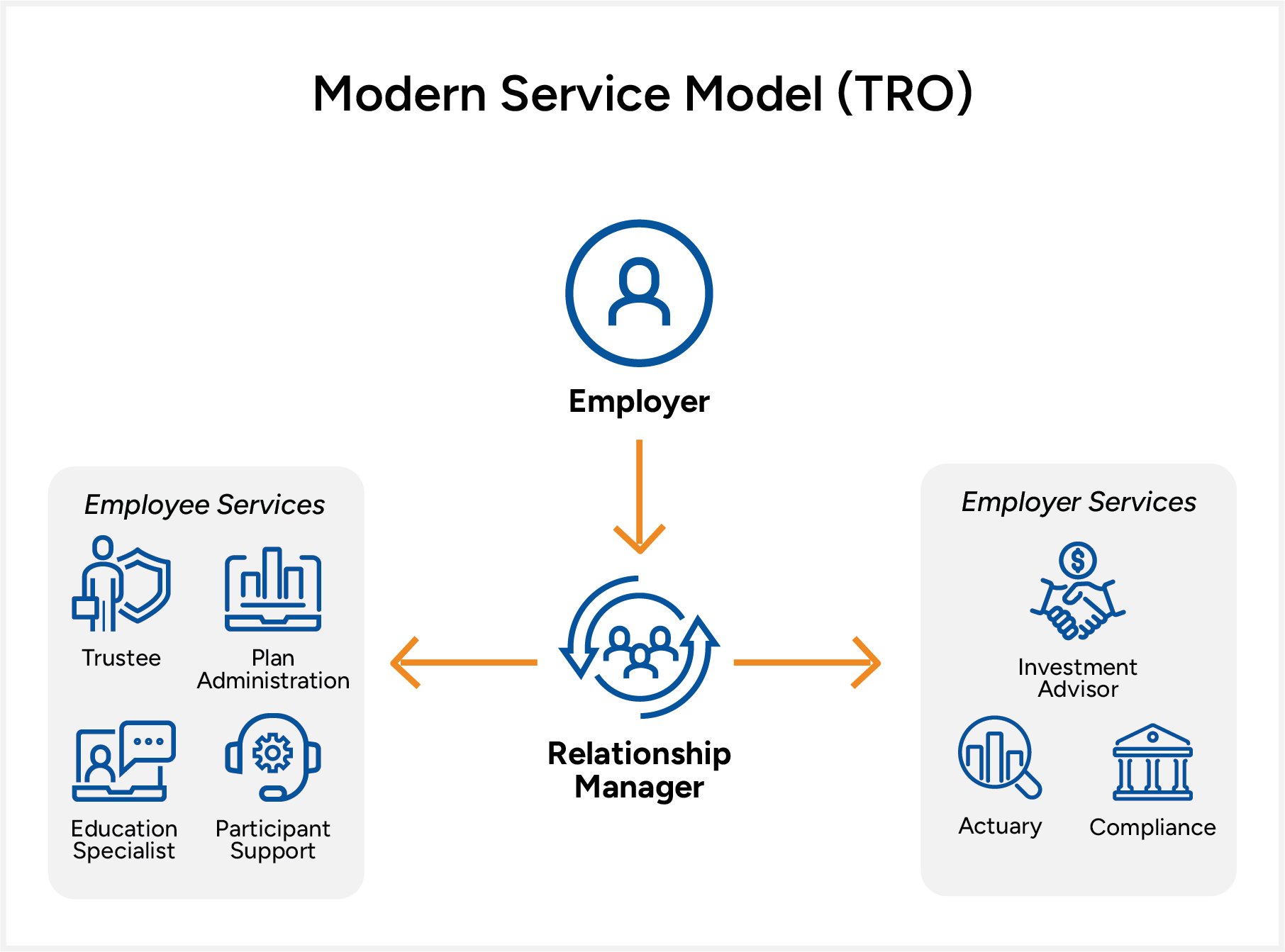

Traditional retirement plan models often involve multiple vendors such as recordkeepers, investment advisors, actuaries, and more, which creates coordination challenges and communication gaps.

TRO replaces this fragmented model with a single relationship manager who oversees a team of experts. This modern approach enhances administrative efficiency and reduces the time and effort required to manage multiple service providers.

3. Enhanced Employee Experience

Today’s employees expect digital access, personalized tools and educational resources to help them make informed financial decisions. TRO providers deliver:

- Secure, single sign-on portals accessible from any device

- Online tools for running retirement scenarios and making investment elections

- Consolidated communications including enrollment and education materials, benefit kits and statements

- Live support from service center representatives for personalized assistance

This integrated experience increases employee awareness of their retirement benefits, encourages participation and boosts satisfaction.

4. Flexibility and Customization

TRO isn’t a one-size-fits-all solution. Employers can choose to fully outsource or retain certain functions, such as working with independent investment advisors or actuaries. A strong TRO provider offers:

- Investment options that accommodate internal or external investment advisors

- Automated custodial, trust administration and benefit payment services

- Customized employee education aligned with company culture

- Proactive plan compliance and actuarial support tailored to evolving needs

This flexibility ensures that TRO can adapt to organizational changes and strategic goals.

5. Strong Security Protocols

With rising cyberthreats, data protection is critical. TRO platforms must include:

- Multilevel authentication and single sign-on access

- Annual cybersecurity audits by external experts

- Robust protocols to prevent fraud and ensure compliance with evolving security standards

Weighing the Risks

Employers that outsource retirement plan administration see measurable efficiencies, which allows them to focus on strategic business tasks. However, employers should be aware of potential risks associated with TRO:

- Loss of direct control over certain plan decisions

- Increased fees due to expanded services

- Possible conflicts of interest in investment management

It’s essential to perform due diligence when selecting a TRO provider. Look for transparency, experience, and a commitment to acting in your organization’s best interest.

How USICG Can Help

As retirement plan demands continue to grow, TRO offers a strategic path forward — one that empowers employers to focus on their core business while delivering exceptional retirement benefits to their workforce.

USI Consulting Group (USICG) offers expert guidance and flexible TRO solutions tailored to your organization’s needs. To learn how we can help you, please contact your USICG representative, visit our Contact Us page, or reach out to us at information@usicg.com.

![]() Follow USICG on LinkedIn to stay up to date with retirement news!

Follow USICG on LinkedIn to stay up to date with retirement news!

Investment advice provided to the Plan by USI Advisors, Inc. Under certain arrangements, securities offered to the Plan through USI Securities, Inc. Member FINRA/SIPC. Both USI Advisors, Inc. and USI Securities, Inc. are affiliates of USI Consulting Group.

This information is provided solely for educational purposes and is not to be construed as investment, legal or tax advice. Prior to acting on this information, we recommend that you seek independent advice specific to your situation from a qualified investment/legal/tax professional. | 1025.S0827.99020

SUBSCRIBE

Get USI insights delivered to your inbox monthly.