Retirement Consulting Insights

Fiduciary Support Reduces ERISA Litigation Risk

NOVEMBER 7, 2023

“What you don’t know won’t hurt you” is not an adage any retirement plan sponsor should follow — and that includes fiduciaries who may not even realize they are, indeed, fiduciaries.

A recent survey indicates 43% of company fiduciaries do not identify themselves as such.1 For those who do recognize their title, nearly 29% are unsure of their fiduciary role.2

Investment oversight of retirement plans is a top priority for employers, and it’s imperative that fiduciaries understand their responsibilities and the associated risks.

|

Under the Employee Retirement Income Security Act (ERISA), a plan fiduciary:

Plan sponsors with limited experience and awareness may increase an employer’s litigation risk. |

Lack of Fiduciary Knowledge Can Be Costly

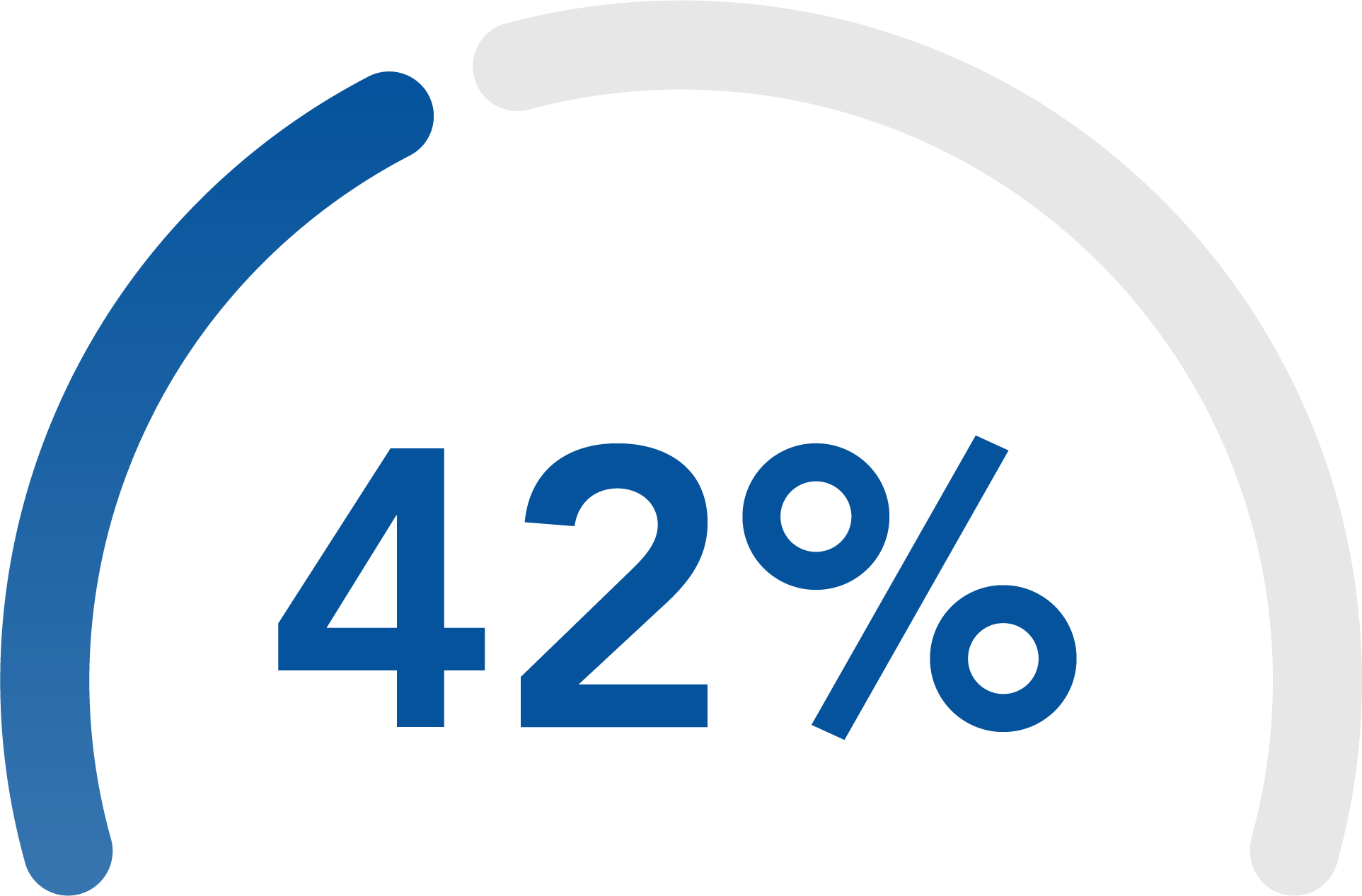

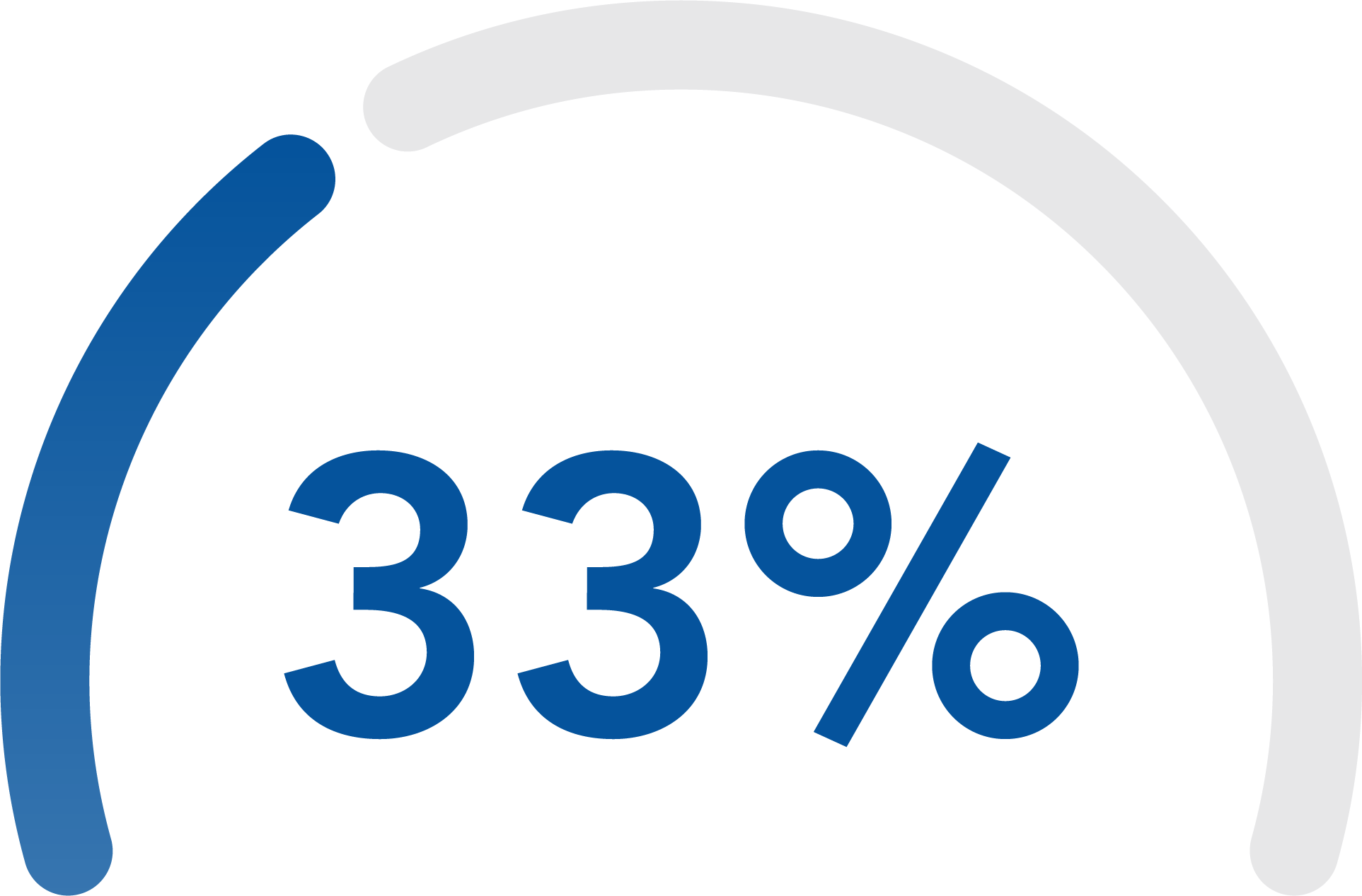

Despite not fully comprehending their fiduciary responsibilities and the related risks, some plan sponsors proceed with making decisions and changes that affect their retirement plans:3

|

|

plan to implement, update |

|

|

plan to evaluate their qualified |

|

|

plan to either add or |

These employers can be exposed to millions of dollars in litigation risk. In fact, recent studies show insurance companies have paid more than $1 billion in settlements.4

The risks include ERISA litigation, which has increased significantly: more than 200 ERISA class action lawsuits have been filed since 2015. Failure to exercise appropriate fiduciary oversight can result in negative financial impact for participants.

A glimpse at the U.S. Department of Labor’s (DOL’s) current list of lawsuits reveals a wide range of fiduciary errors related to improperly managing investments and making imprudent investments. These errors cost retirement plans millions of dollars and loss of benefits to some plan participants.

Fiduciary Support That Fits

You don’t have to shoulder all the responsibility for investment selection or be an investment expert. USI Consulting Group (USICG) helps employers reduce their fiduciary liability by providing enhanced investment oversight and holistic plan governance through ERISA 3(38) or 3(21) service models. USICG offers customized, flexible fiduciary support depending on the employer’s level of involvement.

| ERISA 3(38) Service Model | ERISA 3(21) Service Model |

|

Investment decisions are made on your behalf by an ERISA 3(38) fiduciary who is an investment manager who:

|

You review and approve investment recommendations made by an ERISA 3(21) fiduciary advisor who:

|

| When selecting fiduciary support, consider these options: | |

|

|

Case Study: Move in the Right Direction With USICG Fiduciary Support

A moving and storage company based in the Northeast selected USICG to provide an ERISA 3(38) service model solution, as its retirement plan committee struggled to meet regularly and wrestled with high investment costs.

USICG uncovered deficiencies in the plan governance where potential penalties could have been levied by the DOL. The issues were corrected as USICG’s team:

- Moved the plan to a 3(38) fiduciary model, which reduces fiduciary liability associated with the investment menu from the plan sponsor to the investment manager

- Transitioned from an all-mutual fund lineup to a collective investment trust (CIT) lineup, reducing investment management expenses from 0.37% to 0.19%

- Diversified the investment menu across new asset classes and streamlined the investment menu to meet the various levels of sophistication and risk tolerance of plan participants

- Negotiated lower recordkeeping fees, moving from 0.46% down to 0.30%

- Eliminated a bundled pricing model and moved to a more transparent fee schedule

- Developed a comprehensive retirement plan education and communication strategy for employees

How USI Consulting Group Can Help

USICG has the expertise to help employers better understand their fiduciary responsibilities and mitigate their fiduciary risk. We provide clients with ongoing investment due diligence support, fiduciary training, plan operations and compliance oversight, periodic provider searches, fee benchmarking and plan design consulting services, whether you select an ERISA 3(21) or 3(38) service model.

To learn more, please contact your USICG representative, visit our Contact Us page or reach out to us at information@usicg.com.

![]() Follow USICG on LinkedIn to stay up to date with retirement news!

Follow USICG on LinkedIn to stay up to date with retirement news!

Sources:

1 JP Morgan Survey

2 PLANSPONSOR Study 2021

3 Callan 2021 Defined Contribution Survey

4 Euclid Fiduciary

Investment advice provided to the Plan by USI Advisors, Inc. Under certain arrangements, securities offered to the Plan through USI Securities, Inc. Member FINRA/SIPC. Both USI Advisors, Inc. and USI Securities, Inc. are affiliates of USI Consulting Group.

This information is provided solely for educational purposes and is not to be construed as investment, legal or tax advice. Prior to acting on this information, we recommend that you seek independent advice specific to your situation from a qualified investment/legal/tax professional. | 1023.S1103.0085

SUBSCRIBE

Get USI insights delivered to your inbox monthly.