Property & Casualty Insights

Bend Your Claim Curve to Improve Your Risk Profile

APRIL 6, 2021

Like investigative journalists who “follow the money” to uncover potential illegal activities, insurance experts follow claims to solve some of today’s most complex business challenges. Insurance claims drive a company’s cost of risk and affect countless other areas of the business. Wherever you stand on the risk financing continuum, from low to high risk retention, focusing on claims and key cost drivers is crucial to the success of your risk management strategy.

For companies that retain more risk to create savings, the impact of claims is not only intricate and far-reaching, but also massive — claims costs typically make up 60% to 80% of these companies’ total cost of risk (TCOR). The risk landscape is also becoming more complex and extensive. The most recent Risk & Insurance Management Society (RIMS) Benchmark Survey in 2019 reported that the average TCOR for businesses was 2.1% higher than the previous year. Since then, the most challenging hard insurance market since the mid-1980s has further increased the cost of risk for many organizations.

How can you reverse these alarming trends and bend your claim curve in a favorable direction? Following are strategies and processes to consider.

Lead With Analytics

An effective claims management strategy leads with analytics and follows with targeted risk control to drive down premium and retained losses. This ultimately improves your risk profile now and in the future.

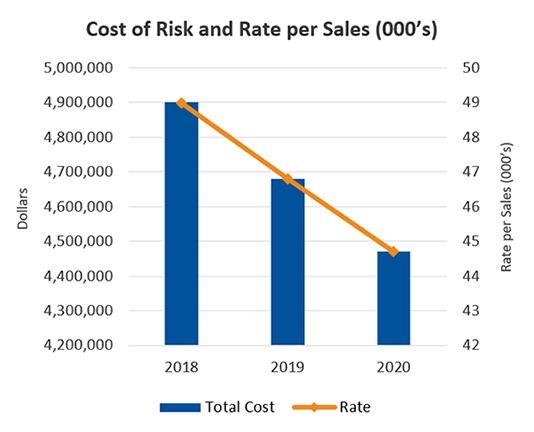

The most effective cost-of-risk benchmarks and forecasts do not rely on insurance carrier projections. The analytics that help you make informed risk financing decisions are based on quantitative analysis and use advanced forecasting, TCOR models and relevant key performance indicators (KPIs). While many business owners and executives consider only costs when determining the success or failure of their insurance programs, it’s important to convert costs to rate per sales and other KPIs to develop meaningful measurements (see chart). You can then accurately target and benchmark different types of jobs, employees, departments and locations — and calculate the ROI of your safety investment.

What Does It Mean to Integrate Key Disciplines?

Like an investigation that requires experts in finance and forensics to carry it out successfully, a business requires specialists in risk control, claims management and analytics to work together to uncover the big picture. This holistic approach allows organizations — especially ones with complex risks — to keep improving their risk management programs and strengthening the bottom line.

Even if these disciplines are well established in an organization, the company could still be ineffective at solving problems, often due to a lack of integration. You have heard of organizational “silos” that work disparately and don’t integrate their expertise or share their knowledge with other areas. This can be especially damaging when pre-loss (risk control) and post-loss (claims management) experts fail to share data and know-how that could significantly impact the total cost of risk.

Consider the advantages of an integrated process in which experts in analytics, risk control and claims management work together. Through analytics, a risk manager may see that a particular location has a poor claims trend. The data may show the location lags in claim reporting and return to work. The risk manager can act on this information, focusing post-loss efforts on effective claim management for that set of claims to contain their overall cost.

A safety professional can drill down into the same dataset to determine loss causes, and possibly find correlations between work shifts, supervisors, past training, and even process design. The safety professional can then apply that insight to pre-loss efforts to prevent claims to begin with.

The real opportunity comes when you focus efforts in a targeted fashion. Once risk management and safety professionals identify key loss drivers, they can focus efforts on those drivers and even more effectively reduce losses. In addition, by using empirical data to measure and demonstrate causation and trends, safety and risk professionals are able to shift from solutions that “should” work to solutions that “will” work — demonstrating a clear return on investment, justifying targeted risk control investments, and ultimately achieving the support of senior leadership.

Targeted Risk Control

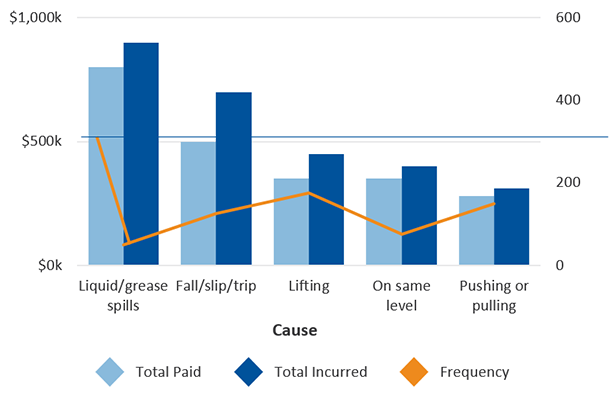

Assume that workers’ compensation accounts for 74% of total losses (severity) when compared to other business risks and 86% of the total incidents (frequency). This is a problem that must be solved with a deeper dive into workers’ compensation losses. Take, for an example, a business that experienced spikes in claim frequency and severity over previous policy years, prompting a more detailed analysis to identify loss drivers. In this case, the leading cause of loss turned out to be liquid/grease spills.

Frequency and Severity by Cause

It’s important to clearly define the financial impact of risk management initiatives. In this example, mitigating claims related to liquid/grease spills alone can create up to around $850,000 in savings. To maximize savings and overall value, the analytics expert must examine all workers’ compensation claim results while isolating the activities and jobs that generate the most claims. Then a targeted safety program must be designed and implemented to address the specific causes of those claims. At USI Insurance Services, our experience has shown that a targeted risk management process focused on reducing and/or eliminating claims and cost drivers can result in premium reductions up to 30%.

Targeted Claim Management

The next step is to take the same workers’ compensation losses to identify cost drivers. Most workers’ compensation costs can be divided into three major buckets: medical, disability (wage replacement and settlement) and legal.

To identify the cost drivers behind medical expenses, review early medical intervention, medical bill repricing, preferred provider organization (PPO) effectiveness, network penetration, diagnostic costs, pharmacy spend and outcome-based medical.

To find the cost drivers behind disability expenses, look at employer engagement, timely claim reporting, return-to-work programs, job assessment and settlement practices.

Reviewing legal spending and other claim management costs can also assure you are getting the most effective solutions. Then, a targeted claim management program can be designed and implemented to address specific claim cost drivers and help to significantly reduce premiums.

Engage in a Comprehensive Process

To achieve and maintain positive results, organizations should implement a process that includes both targeted risk control and claims management:

- Review claims and claim trends. Specifically, review claim frequency, severity and claim type by policy year and compare it to leading causes of loss across your industry.

- Identify and analyze loss trends. Analyze potential cost drivers by line of coverage and cause of loss/injury.

- Quantify claims. How are the claims impacting current premium and experience modification (MOD) calculation?

- Create targeted risk control and claim management programs. The plans should address leading indicators from an industry and company perspective to proactively mitigate cost drivers.

- Monitor progress and financial impact. Implement the targeted risk control and claim management plans, and measure outcomes.

How USI Can Help

At USI, we take a holistic approach to mitigating claims and premium costs by integrating claims management, risk control and analytics into one comprehensive, seamless process. Many other organizations treat these disciplines as individual siloed solutions. But understanding how targeted mitigation efforts can impact future premium is critical to developing an effective, sustainable risk control plan — one that is structured to promote ongoing improvement.

We continuously evaluate the cost of adverse claim trends and project the financial impact of implementing risk control plans for our clients. This provides them a clear understanding of how risks impact costs and cash flow, so they can calculate ROI by measuring costs of specific safety improvements against future premium and claims savings. Our experienced analytics team can help design and implement a comprehensive risk management program focused on protecting your organization and reducing your cost of risk, allowing you to:

- Prioritize your risk management and mitigation strategies

- Measure and benchmark the overall performance of your insurance programs

- Ensure ongoing improvement as your risks change

Learn More

By applying these risk management disciplines, USI can help you identify and implement an effective, long-term risk management strategy/solution.

To learn more about the risk management services available through USI, contact your USI consultant or visit www.usi.com.

SUBSCRIBE

Get USI insights delivered to your inbox monthly.