Employee Benefits Insights

Mind Body Money: A Holistic Approach to Employee Well-Being

FEBRUARY 6, 2024

Given the compounding effect of employee financial stress and emotional well-being on health outcomes and the cost of care, organizations should strive to address the stressors that impact employees’ ability to effectively perform at work:

- Physical well-being — USI Insurance Services has found that for some employers, 50% of catastrophic claims are tied to individuals who have not had a preventative care visit in the prior 12 months, and only 20% to 30% of adult health plan members engage annually with a primary care physician.1

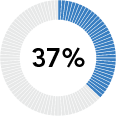

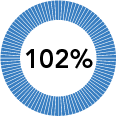

- Emotional well-being — Of the 21% of American adults estimated to have a behavioral health condition2 (including depression and anxiety), as many as a third are not receiving the care they need. Poor mental health is also known to drive up the cost of care 37% to 100% for certain chronic conditions.3

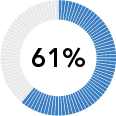

- Financial well-being — 60% of full-time employees report being stressed about finances, and 56% admit to spending at least three work hours per week dealing with or thinking about personal finances.4

Undiagnosed or unmanaged depression is a known contributor to higher healthcare costs

Increase in Costs by Health Condition

|

|

Ulcerative colitis, cirrhosis, |

|

|

Cancer, chronic liver disease, |

|

|

Hypertension (high blood pressure),

|

To help employers reduce the impact on health plan spending while ensuring employees’ wellness needs are being met, USI has developed Mind Body Money (MBM). Building on the foundation of USI’s CORE health strategy, MBM helps employers take a holistic approach to employee well-being and encourages health plan members to make positive behavioral changes including:

- Engaging with a primary care physician for annual preventative care and recommended screenings, including behavioral health, to identify undiagnosed or unmanaged conditions, and

- Completing a financial health assessment to determine the level of financial education and resources needed, as well as accessing certified financial planners

How USI Can Help

USI can assist in designing a comprehensive employee engagement strategy to improve workforce readiness and health outcomes — and reduce the financial impact on health plan spending. Our population health management team can help your organization:

- Choose an appropriate vendor based on your budget and goals

- Create meaningful participation by aligning employee incentives with your company’s culture

- Ensure compliance with numerous regulatory requirements regarding incentivized contribution strategies

- Develop a targeted communications strategy, including appropriate notice and disclosure, using a multichannel approach to reach a diverse workforce

When employees’ wellness needs are being met, employers can significantly improve job satisfaction and productivity while reducing the financial impact of a disengaged workforce. Contact your local USI benefits consultant or email ebsolutions@usi.com to learn more about this and other population health strategies designed to better manage health plan spending.

Sources:

1,3 USI 3D client data

2 National Alliance on Mental Illness (NAMI), Mental Health By the Numbers

4 PWC, PwC’s 2023 Employee Financial Wellness

SUBSCRIBE

Get USI insights delivered to your inbox monthly.