Property & Casualty Insights

3 Steps to Managing Contractual Exposures as Third-Party Risks Increase

AUGUST 3, 2021

As business relationships, supply chains and operations evolve, contract language must continue to align with contractual obligations and insurance policy terms. Otherwise, companies can be (and are being) held liable for massive uninsured losses.

A 2018 Ponemon Institute study reports that for cyber events alone, 59% of companies have experienced contractual exposures caused by one of their vendors or third parties, and only 16% of companies claim they effectively mitigate third-party risks. Fifty-six percent of businesses have recently renegotiated their third-party contracts, according to a 2020 study by RetailNext.

Companies that enter into agreements with vendors often focus solely on what is required within the contract — not the insurance required to protect them from the risks they assume or transfer. Liability for personal injury or property damage routinely falls on businesses whose contract language fails to include insurance coverage, which should come from the contractors responsible for snow and ice removal, maintenance of facility and grounds, leased facilities, and other obligations. According to 2021 data from Evident, a specialist in third-party risk:

- 75% of third parties are not meeting insurance requirements established by companies

- At least 10% of third-party vendors fall out of insurance compliance without notifying the companies that hire them

- 23% of third-party vendors do not respond at all to companies’ requests for proof of insurance

These practices may increase the liability for expenses involving:

- General and professional liability

- Property/assets

- Product liability

- Product recall

- Cyber liability

- Damage to reputation

- Environmental losses

For example, consider contract language that does not adequately address exposures associated with planned building renovations. During renovation and installation of a new roof, several pedestrians are injured by falling materials. A claim is filed against the roofing contractor and the building owner.

Because the building owner is not included as an additional insured on the roofing contractor’s policy, the building owner absorbs a $250,000 claim against his general liability (GL) policy. If the building owner had scheduled a contract review prior to the renovation, he could have broadened his coverage position by being included as an additional insured on the roofing contractor’s policy — and he could have avoided these losses.

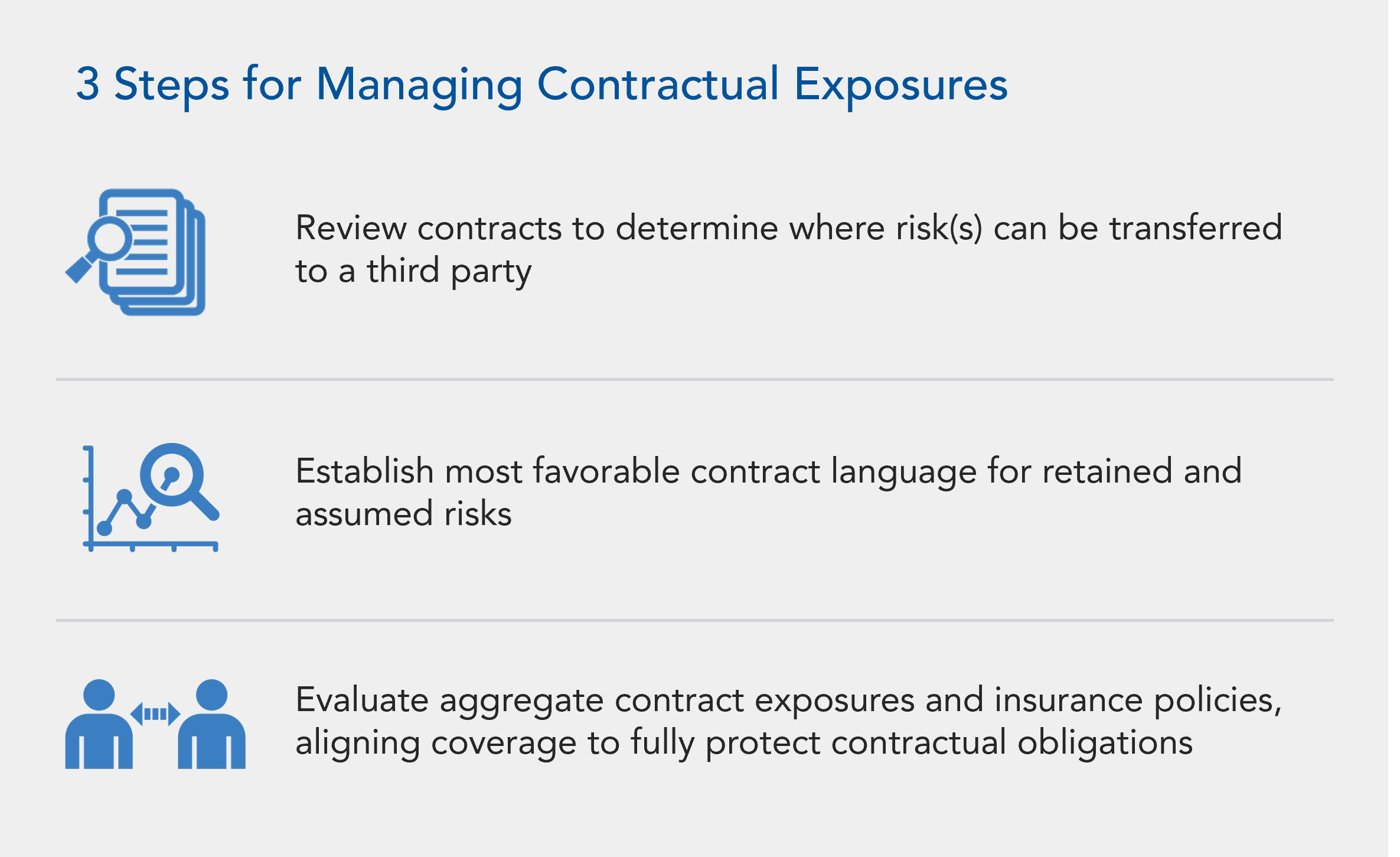

Take These Three Steps to Manage Contractual Exposures

To effectively manage contractual risk, organizations must continually review and improve their third-party contract language and the alignment of insurance policy terms with contractual obligations. A comprehensive review process is key, and it includes the following three steps:

- Review and identify where risk can be transferred to a third party. Consider a company that hires a contractor to remove snow and ice. The contract requires the snow removal company to carry GL insurance. During the winter, a customer falls on some ice on the company’s property. The customer sues the company, which tenders the claim to the contractor for defense. However, the contractor’s insurance carrier denies the claim, noting that there was no defense or indemnification provision in the contract. The company has no alternative but to submit a claim under its own policy, which has a $100,000 deductible, resulting in out-of-pocket costs for the company.

To avoid this type of scenario, the company could have required the contractor to name the company as an additional insured on a primary and non-contributory basis under the policy. The contract language could have also been revised to include indemnification/hold harmless and waiver of subrogation provisions. The resulting financial impact for the company would have been equal to the $100,000 deductible, as well as transfer of future liabilities to the contractor, up to the policy limit. - Review and obtain optimal contract language when assuming risk. This step involves a review of contractual obligations to obtain the most favorable contract language. For example, a business is looking to rent a warehousing facility, and the lease requires the business to hold the landlord harmless from all liabilities related to hazardous substances, with limits of $25,000,000. The business does not feel that such a high limit is warranted, nor does it want to incur the additional $100,000 premium. A comprehensive risk assessment, benchmarking and analytics show the landlord that her liability exposure is minimal. The business successfully negotiates lower limits in the contract, resulting in a premium savings of $75,000 and compliance with the lease agreement.

- Review contract exposures and current insurance policies. A comprehensive review of contractual obligations and policies will help ensure coverage is aligned with contractual exposures, preventing an uncovered loss. For example, a manufacturer is looking to enter into a supplier agreement with a customer, which requires the manufacturer to protect and indemnify the customer from any loss arising out of bodily injury, property damage and any other damages or loss related to product failure, design and installation error. However, the manufacturer’s GL policy only provides coverage for claims arising out of bodily injury and property damage. Therefore, the manufacturer purchases a separate errors and omissions (E&O) policy for $12,500 additional premium to address other damages or non-bodily injury and property damage claims, such as third-party financial loss. This prevents a potential breach of contract and an uncovered E&O claim up to the policy limit of $1,000,000.

How USI Can Help

Liabilities between companies are often transferred by contract. Both the company that transfers liability, and the company that assumes liability, will require adequate insurance coverage to support the liability transferred. USI Insurance Services reviews client contracts and coverage to ensure the content of the relevant policies supports the agreed contractual obligations.

With the three steps listed in the previous section, USI assists clients in managing risk assumed under contract with improved contract language and alignment of policy terms with contractual obligations. This allows for informed risk management decisions when transferring, assuming and protecting against third-party liabilities, and protects against uncovered losses up to the policy limit and/or the value of the contract.

For assistance managing your organization’s contractual exposures, contact your USI representative.

Sources:

https://www.businesswire.com/news/home/20181115005665/en/Opus-Ponemon-Institute-Announce-Results-of-2018-Third-Party-Data-Risk-Study-59-of-Companies-Experienced-a-Third-Party-Data-Breach-Yet-Only-16-Say-They-Effectively-Mitigate-Third-Party-Risks

https://financesonline.com/supply-chain-statistics/

https://www.evidentid.com/

SUBSCRIBE

Get USI insights delivered to your inbox monthly.