Property & Casualty Insights

Is Your Targeted Risk Control Process Effective — Or a Liability?

SEPTEMBER 7, 2021

While lists of “Top Workplace Risks” are popular, key risks vary from industry to industry, business to business, and even year to year for many organizations. That’s why effective strategies focus on the process of identifying critical risks and targeting them with best-in-class solutions — and continually repeating this process to ensure ongoing improvement and cost savings.

Businesses spend $170 billion a year on costs associated with occupational injuries and illnesses that impact the bottom line. The recent increase in “mega claims” (those typically totaling $3 million or more in incurred losses) to a 12-year high further complicates the issue. These measurable losses allow companies to calculate return on investment (ROI) when taking specific loss control actions that they can measure against improved loss experience.

However, few people realize how rare an effective risk control process is — one that truly fires on all cylinders. Naming each “cylinder” can help clarify how the process works:

- Claims: Do you analyze claims from all insurance lines to identify specific loss trends? Claims are more than workers’ compensation — you should also incorporate property loss, general liability and other exposures into your targeted risk control process.

- Targeted risk control: Do you implement robust solutions to solve these loss trends and prevent future claims?

- Analytics: Do you continually measure all factors and determine which risk management strategies are (and are not) delivering ROI and consistent process improvement?

Many businesses do a great job on one or two of these objectives, but that’s not enough. A truly effective risk control process includes specific steps that must be followed correctly and consistently. If they’re not, the process won’t be effective, or, at worst, could result in costly damage. If you identify the wrong loss trends, for example, you will end up investing in the wrong solutions, which would both waste money and fail to solve the root problems. If those problems remain, the losses continue to grow and start a domino effect. Therefore, the wrong risk control process can waste resources and neglect costly liabilities. From a cost-benefit standpoint, investing in a poor risk control process can be worse than doing nothing.

While success might seem straightforward, there are a lot of moving parts and high-stakes decisions involved. Claims costs typically make up 60% to 80% of an organization’s premium and total cost of risk (TCOR). A breakdown in one step can compound costly problems in the subsequent steps. That’s why an effective risk control process is critically important.

Targeted, Integrated Risk Control Process

The Power of an Integrated Process

We often use the words “integrated” and “holistic” when describing a targeted risk control process, which simply means all three cylinders mentioned above are firing efficiently. An integrated process can help move your business forward, while a disjointed or siloed approach can cause it to break down.

An effective risk control process includes claims review, loss trend analysis, safety inspections and other key tactics that allow organizations to analyze the root causes of loss and take control of them. This approach provides a clear understanding of the risks that are impacting premium development and cash flow.

Let’s take a closer look at the essential steps in the targeted risk control process.

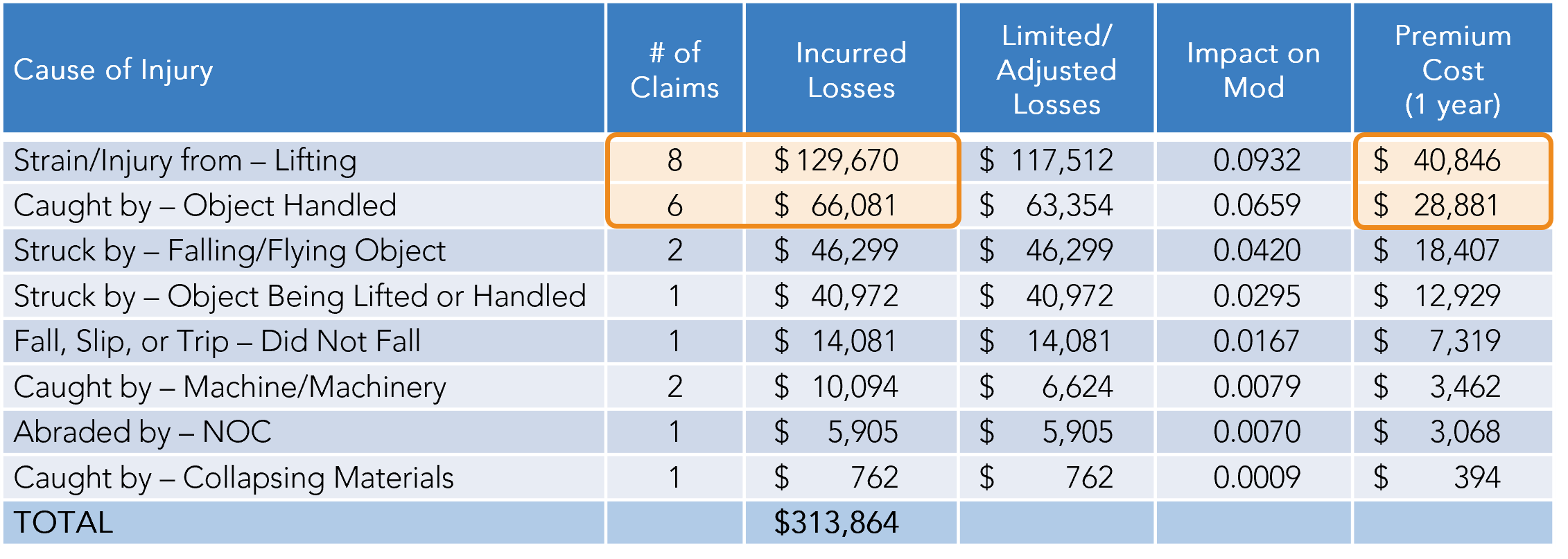

- Continually identify root causes of loss. For example, this forensic review of a company’s loss history allowed them to identify specific loss trends:

The numbers in the highlighted boxes worked out to be 64% of claim frequency and 62% of claim severity. This detailed analysis enabled USI Insurance Services’ risk control consultants to focus on the key cost drivers, root causes and exposures when completing a comprehensive risk inspection of the operations and safety procedures. - Implement a targeted risk control process. Identifying the cost drivers is only part of the battle, and mitigating or eliminating them is one of the next critical objectives. It’s important to realize that multiple objectives remain after identifying loss trends, as the forensic data is a gold mine that can benefit several disciplines while compounding your improvements and cost savings. This leads to a truly integrated approach, which involves analytics, claims and risk control teams working seamlessly together to reduce claim frequency, severity and cost of risk.

For example, the company discussed above, whose manual material handling claims were predominant, implemented a program focused on preventing strains and sprain injuries. This helped to:

-

Further identify and analyze the types and causes of losses by location and job function.

-

Conduct a job hazard analysis (JHA) to identify the root cause of losses.

-

Conduct an ergonomics review to determine if physical changes to the workplace will minimize exposure (e.g., raising the height of a lift or automating a process).

-

Require the use of wearable technology, sensors and guards to monitor and improve employee safety and prevent overexertion while performing certain tasks.

-

Assess the potential for job rotation to minimize repetitive stress claims.

-

By mitigating or eliminating these claims, the company was able to recover a portion of the $69,727 in premium costs and reduce total premium by 16%.

- Measure ROI to achieve continuous improvement as business operations and risks evolve. By using empirical data to measure and demonstrate causation and trends, risk, safety and claims professionals can shift from generic tactics to solutions that are proven to work. This allows them to demonstrate a clear ROI, justify and prioritize targeted risk control investments, and ultimately achieve the support of senior leadership.

Especially with today’s changing risk landscape (due to the pandemic, labor shifts and shortages, and other factors), only a holistic process will determine which risks should be top priorities and how to mitigate them. We have found that reducing and/or eliminating the frequency and severity of incurred claims and cost drivers can lead to a reduction in premiums and actual claim dollars by up to 30%.

How USI Can Help

It's important to follow all three of these steps on a consistent basis to maintain lasting improvements and cost management. Understanding how targeted mitigation efforts can impact future premium is critical to developing an effective, sustainable risk control plan — one that is structured to promote ongoing improvement.

- USI’s inspection platform enables us to partner with our clients and jointly perform a risk control inspection (virtually or in person) of the client’s facilities and operating procedures.

- Our inspection focuses on client’s loss trends and identifying program deficiencies, behaviors, activities and exposures that may cause losses.

- Client’s inspection results and safety program are evaluated against OSHA, NFPA (National Fire Protection Association), FMCSA (Federal Motor Carrier Safety Administration) and industry best practices, with performance ratings assigned.

- Photos and results are uploaded into USI’s inspection platform for continued follow-up, training and improvement tracking by USI and the client.

- Based on inspection results and loss analysis, a targeted risk control plan is developed, providing specific recommendations and solutions to address risk exposures and cost drivers and prevent workers’ compensation injuries.

Learn More

By applying these risk management disciplines, USI can help you identify and implement effective, long-term risk management strategies and solutions. To learn more about the risk management services available through USI, contact your USI consultant.

SUBSCRIBE

Get USI insights delivered to your inbox monthly.