Property & Casualty Insights

Think Like a Gamer: Strategies for Lowering Your E-Mod and Workers’ Comp Costs

DECEMBER 5, 2023

A speaker at a recent workers' compensation forum compared the workers’ comp experience modification (e-mod) factor to a common feature in video games, which rewards players who simply play the game as intended. Completing certain tasks would increase the rate at which a character leveled up, while failing to complete them would cause the player to gain points more slowly.

Since the e-mod factor for employers works in essentially the same way, organizations would do well to improve their e-mod with the analytical approach and dedication of a hardcore gamer. For example, employers can make workplace safety a mission to lower their e-mods, thereby decreasing their insurance costs and increasing their bottom lines. However, if they fail to complete the required missions, their e-mods can increase and multiply the costs of insurance — which can mean “game over” for many organizations.

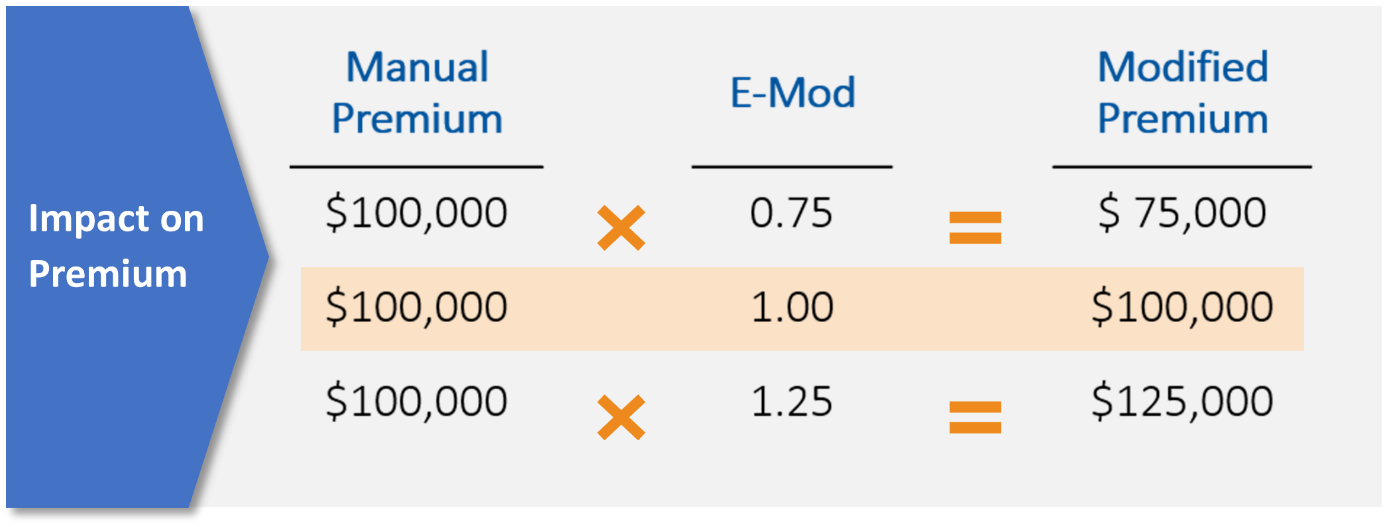

The e-mod is an indicator of an employer’s workers’ compensation loss history compared to its peers in the same industry and state, and is used as a multiplier to increase or decrease premiums — mainly of guaranteed-cost insurance policies. For example, an e-mod of 1.25 leads to a 25% increase in premium, while an e-mod of 0.75 results in a 25% premium reduction.

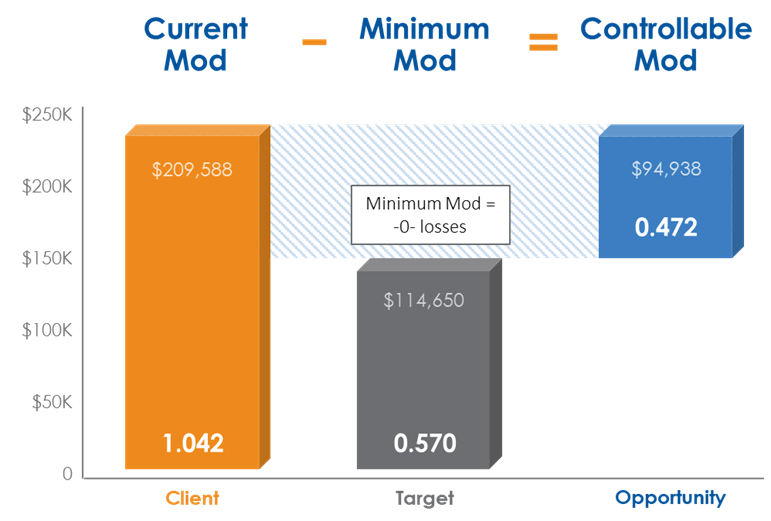

Well-informed employers will obtain an annual review of the data used in their e-mod calculation and the actual promulgation of their e-mod. But a more comprehensive analysis that focuses on the “controllable mod” and the losses driving current costs is equally valuable. For some organizations, these opportunities can reduce premiums by 5% to 15% in the first year and create potential future savings up to 30%.

Prevent Losses From Occurring

Employers can take many steps to prevent claims through loss control and safety programs, which should include:

- Identifying and mitigating risks — Conduct thorough risk assessments to identify potential workplace hazards. Once identified, take steps to mitigate or eliminate these risks.

- Safety training — Provide comprehensive safety training to all employees. Ensure they understand the risks associated with their roles and how to minimize them.

- Safety policies — Develop and enforce clear safety policies and procedures. Make sure employees are aware of these policies and know where to find them.

- Regular inspections — Look for potential hazards in the workplace and address any issues promptly.

- Hazard reporting — Encourage employees to report hazards or near-miss incidents so proper controls can be put in place for the future. Create a culture where reporting is encouraged and not met with repercussions.

- Safety equipment — Provide appropriate protective gear and tools, and ensure employees use them.

- Return-to-work programs — Facilitate a safe and timely return to work for injured employees.

These are just a few measures employers can use to create a safer work environment and reduce the risk of injuries and losses.

Don’t Let E-mod Errors Drive Up Costs

Because promulgation of the e-mod is complex, the process often results in errors and inflated premiums. E-mods are calculated using each employer’s own losses and audited payrolls reported by the insurer to the states’ rating bureaus or advisory boards. Errors in the data used to determine the e-mod and the actual calculation of your organization's factor can occur, impacting the e-mod and the premium you must pay. These key factors drive the calculation:

- Job classification — Are your class codes accurate? Changes in operations, staff and job responsibilities can result in miscoding errors and overpayment of your workers’ compensation premium.

- Payroll — This may be erroneously overstated (e.g., overtime and bonus payroll, or certain portions of executive compensation).

- Claims — Are claims and reserves accurate? E-mod is calculated based on the last three years of claim history (not including the most recent year). Inflated loss reserves will negatively impact the e-mod. Additionally, clerical errors when inputting data can sometimes result in the claims of one insured erroneously finding their way onto another insured’s e-mod calculations.

An error in any of these areas can result in overpayment of premium. An effective analysis will review all data used to calculate the e-mod, correcting errors and ensuring that premiums reflect e-mod improvement.

Unlock Workers’ Comp Cost Savings With Analytics and Targeted Risk Management

Following a review and confirmation of your e-mod’s accuracy, a more comprehensive analysis is critical for quantifying your future opportunity to further improve your e-mod. The analysis pivots from a retrospective review to a prospective analysis of your controllable e-mod, and to the future saving opportunity if you continue to drive down your e-mod.

The controllable mod represents the improvements employers can make by reducing losses with targeted risk management strategies. Once the controllable mod is established, a detailed claims analysis will determine which claims and trends drive the current e-mod and prevent continued savings. The analysis should focus on historical loss trends, such as the nature, cause and location of losses, with attention given to the impact these losses have on your e-mod and resulting workers’ compensation premium.

How USI Can Help

USI Insurance Services assists clients in ensuring the accuracy of their e-mod and reducing workers’ compensation premium costs. We use the same tools and information as the regulatory agencies to calculate the workers’ compensation experience modifier, identifying any incorrectly promulgated mods and making corrections where needed.

By evaluating the incoming data, loss trends and risk-control plans, USI can:

- Identify and retroactively correct mistakes, leading to premium savings.

- Prevent statistical errors.

- Project the anticipated mod changes.

- Complete claim reviews to identify trends and ensure proper reserving and closing strategy.

- Develop a targeted risk control plan focused on claim trends to reduce the mod by driving down losses and preventing them from occurring in the first place.

- Implement programs that handle claims after a loss, including modified-duty return-to-work programs and aggressive pursuit of subrogation (claim reimbursement), which can reduce losses that negatively impact the e-mod.

To learn more about the e-mod review services available through USI, contact your USI consultant or email pcinquiries@usi.com.

|

Employer Alert – Key Changes to NCCI’s Experience Modification Factor for 2024: Learn how adjustments to the 2024 e-mod rules affect many employers. |

SUBSCRIBE

Get USI insights delivered to your inbox monthly.