Retirement Consulting Insights

A Look Ahead: What’s On the Horizon for Retirement in 2022

JANUARY 4, 2022

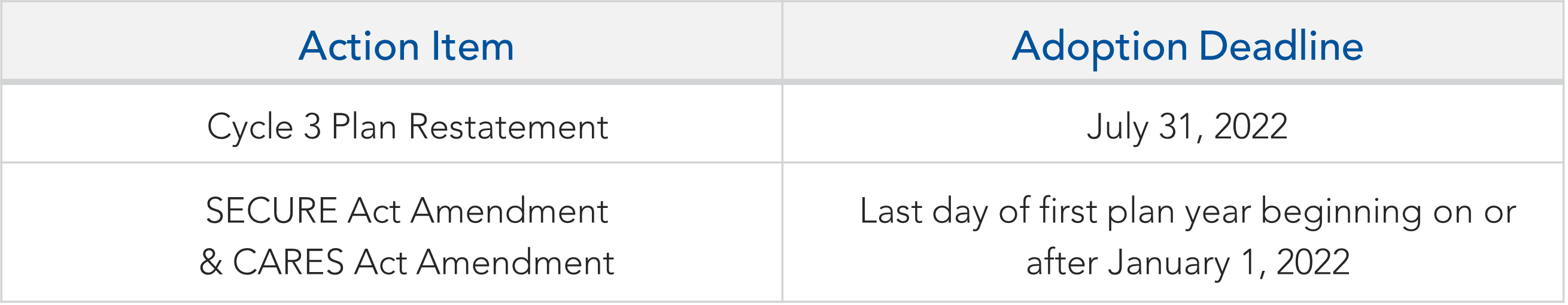

Set your organization up for success in the new year by marking your calendars with important compliance requirements. Following is a summary of the key 2022 action items and deadlines.

Required Plan Amendments & Plan Restatements

In 2022, most defined contribution (DC) retirement plan sponsors will need to adopt certain required plan amendments and restate their plan documents to reflect applicable law changes. Fees for preparing such amendments and restatements may be charged against plan assets as administrative expenses, and the failure to adopt amendments and restatements on a timely basis may result in significant penalties and adverse tax consequences.

Cycle 3 Plan Restatement

Under the “Cycle 3 Remedial Amendment Period,” all 401(k) plans, profit-sharing plans, money purchase pension plans and employee stock ownership plans (ESOPs) that make use of IRS preapproved plan documents must be updated and restated in full, no later than July 31, 2022, to reflect all applicable law changes and discretionary amendments that were made since the end of the last six years remedial amendment period. For a detailed discussion of the Cycle 3 Plan Restatement requirements, please see our October 2020 Benefits in Focus Plan Sponsor Newsletter.

SECURE Act Amendment

Retirement plan sponsors generally have until the last day of the 2022 plan year to adopt amendments that reflect the SECURE Act’s required or optional provisions. For calendar year plans, the deadline is December 31, 2022. Under the Setting Every Community Up for Retirement Enhancement Act of 2019 (SECURE Act), the following mandatory and optional changes were made to the rules governing DC plans:

- Inclusion of part-time workers — Beginning in 2024, 401(k) plan sponsors must generally permit long-term service part-time employees who are at least age 21, and who have completed between 500 and 1,000 hours of service during three consecutive years, the opportunity to make elective deferrals under their respective plans.

- Required minimum distributions (RMDs) — Beginning in 2020, the age for determining if a participant must begin receiving RMDs was raised from age 70 ½ to age 72. In addition, on a discretionary basis, plan sponsors may continue to allow actively employed participants who are over age 72 to continue to defer the commencement of RMDs until the year that they retire, and surviving spouses of participants may delay commencing RMDs until the participant would have attained age 72.

- Lifetime income disclosures — Beginning in 2022, DC plan sponsors are generally required to provide plan participants with detailed lifetime income disclosure illustrations at least annually. These are intended to give participants a realistic idea of what their monthly retirement income could be based on their retirement savings and/or current rate of savings.

- For participant-directed plans, the first annual disclosure must generally be provided no later than with the second 2022 quarterly benefit statement.

- For non-participant-directed plans, the first annual disclosure must be provided as part of each participant’s annual benefit statement for 2021.

- A more detailed discussion can be found on Pages 2 and 3 of our September 2021 Market & Legal Update.

- Birth and adoption distributions — Beginning January 1, 2020, on a discretionary basis, DC plan sponsors can permit plan participants to elect to receive penalty-free distributions of up to $5,000 of their vested account balances in the case of the birth or adoption of a child, and to repay such amount later to potentially avoid income taxes.

CARES Act Amendment

In 2020, under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), DC plan sponsors were permitted to adopt the following plan changes on a discretionary basis. If plan sponsors elected to implement these provisions, plan amendments are required by the end of the plan year beginning on or after January 1, 2022 (December 31, 2022, for calendar year plans).

- COVID-19-related distributions — “Qualified individuals” could be permitted to receive coronavirus-related distributions (CRDs) of up to $100,000 between January 1 and December 31, 2020. CRDs were subject to income tax, but not the 10% early withdrawal penalty and 20% mandatory income tax withholding. In addition, at the election of the person receiving such distribution, the distribution could be ratably included in taxable income over a three-year period, and such taxes could be avoided completely if the distribution is repaid to the plan or to an IRA within three years.

- Plan loans — Between March 27, 2020, and September 22, 2020, the maximum limit for DC plan loans made to participants who were “qualified individuals” could be increased to the lesser of $100,000 or 100% of the participant’s vested account balance under the plan. In addition, loan repayments due from March 27, 2020, to December 31, 2020, could be deferred for up to one year and the principal and interest on a plan loan could be ratably reamortized for a period of up to one year after the original final payment due date.

- Required minimum distributions (RMDs) — DC plans need not be required to make RMDs in 2020 and such distributions, if made, could be rolled over to an IRA or to another qualified plan by the person receiving such distribution.

Additional Resources & Tools

2022 Retirement Plan Compliance Calendars

Plan sponsors can access further guidance on the regular administrative compliance deadlines with our calendars:

2022 Cost of Living Adjustments

The IRS publishes cost-of-living adjustments (COLA) applicable to defined benefit and defined contribution plans on an annual basis. The 2022 adjustments can be accessed here.

How USI Consulting Group Can Help

As you note the action items and corresponding deadlines for 2022, remember that USI Consulting Group (USICG) can assist with all retirement plan compliance matters and help you mitigate risk and financial impact to your organization. To learn more, please contact your local USICG representative, email information@usicg.com or visit www.usicg.com.

SUBSCRIBE

Get USI insights delivered to your inbox monthly.