Retirement Consulting and Employee Benefits Insights

Holistic Tax-Advantaged Benefit Strategy: A Smarter Way to Optimize Employee Benefits

FEBRUARY 3, 2026

What if your organization could save tens of thousands of dollars or more annually without cutting benefits? Economic volatility, escalating healthcare costs and fierce competition for talent are reshaping the employee benefits landscape. Forward-thinking employers must ensure benefits spending delivers maximum impact while transforming benefits into a strategic lever for resilience, growth and talent advantage.

The Case for Aligning Health and Retirement

Too often, health and retirement benefits are managed separately in companies, which leads to missed opportunities to optimize the full spectrum of employee benefit offerings. For instance, one often-overlooked factor is that U.S. employers pay 7.65% in FICA taxes on their employees’ compensation — which usually includes contributions to employee benefits as well.

By taking an integrated approach to managing health and retirement programs, employers can unlock meaningful tax efficiencies across health savings accounts (HSAs), flexible spending accounts (FSAs), transportation benefits, and retirement plans like 401(k)s and 403(b)s. The real driver of these savings? Increasing employee participation in tax-advantaged plans.

When employees engage more fully, employers benefit directly. By increasing employee participation in tax-advantaged plans, employers can expect to see these estimated savings:

For a 100-person company, that could mean up to $60,000 in annual savings for enhanced participation. Larger employers could achieve six-figure reductions in federal tax liability.

Beyond annual tax savings, an effective tax-advantaged benefit strategy also helps address long-term workforce challenges, such as delayed retirement, which can cost employers up to $50,000 per employee per year in wages and healthcare premiums.3 For larger organizations, this can translate into millions of dollars in avoidable costs over time.

This integrated strategy can also enhance employee financial wellness, reveal opportunities to streamline benefit administration, and help employers and employees extract more value from every dollar spent on benefits.

Delivering Integrated Benefit Strategy Differently

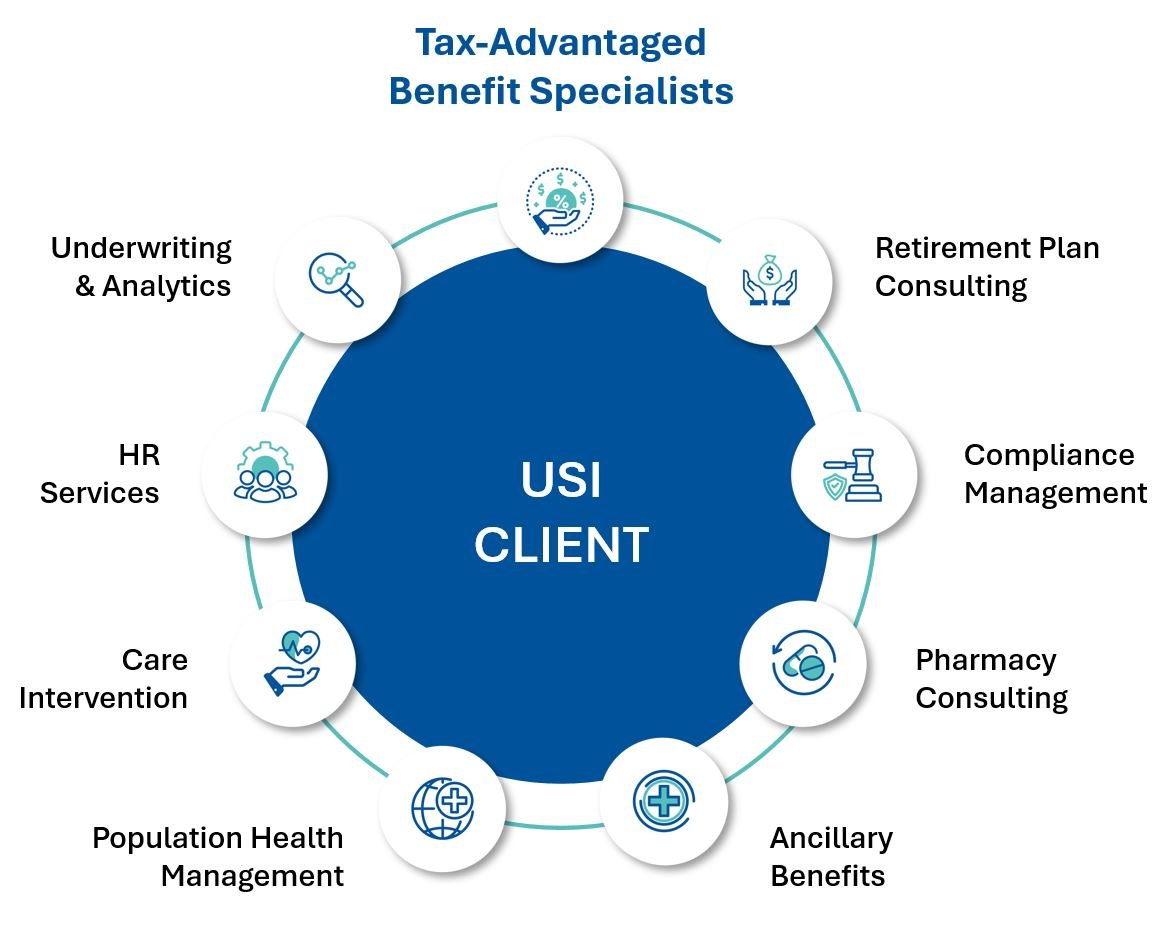

At USI, we’ve reimagined how employers can integrate these strategies to reduce employer tax liability, enhance employee engagement, and improve financial wellness.

Our innovative consulting model embeds retirement expertise within the employee benefits team, allowing our tax-advantaged benefit strategy specialists to uncover tax efficiencies HSAs, FSAs, transportation benefits, and retirement plans like 401(k)s and 403(b)s.

HSAs: The Triple-Tax Advantage That Boosts Retirement Readiness

HSAs have been around for years and are widely recognized by HR managers and employees. However, organizations often overlook the significant value HSAs deliver when their employees participate. Available to enrollees in a qualified high-deductible health plan (QHDHP), HSAs offer unique advantages, including:

- Tax-free contributions for both employers and plan participants (up to the annual limit).

- Tax-free investment growth and withdrawals for qualified medical expenses for the account holder.

- Greater after-tax spending power for participants who combine HSA and 401(k) retirement savings strategies vs. a 401(k)-only strategy.

- Expanded flexibility after age 65 when HSA funds can be used tax-free to reimburse medical expenses incurred in prior years, to pay for ongoing medical expenses, or withdrawn as cash and taxed as ordinary income, similar to assets in a 401(k) account.

For employers, the benefits go beyond supporting employee financial wellness. Every dollar contributed to an HSA reduces taxable payroll, lowering FICA obligations and creating direct cost savings. When participation increases, those savings compound — making HSAs not just a smart choice for employees, but a strategic advantage for employers.

|

|

With average healthcare costs for retirees estimated at $172,500, HSAs can be a powerful planning tool, helping employees prepare for expenses in retirement.4 |

A Smarter Blueprint for Employee Contributions

USI recommends a “next best dollar” approach to help employees prioritize contributions to available tax-advantaged accounts focused on maximizing retirement savings and reducing out-of-pocket costs. Employers can further drive engagement by shifting from seed contributions to an HSA match strategy. This approach encourages employee participation, increases savings, and supports the adoption of QHDHPs — delivering cost savings for both parties.5

Empower Employees and Strengthen Their Retirement Readiness

By offering the right mix of benefits — HSA match programs, automatic retirement plan enrollment and well-designed employee benefit offerings — employers can empower employees to save effectively and retire on time while optimizing the value of benefit spend. Financial education and easy-to-use benefit platforms also maximize impact. All these elements work together to drive participation, improve financial outcomes, and build a more engaged, productive workforce.

How USI Can Help

USI partners with clients to audit their benefits strategy and uncover hidden value that supports their bottom line and workforce. Whether you’re looking to enhance your current offerings or build a new benefits package from the ground up, our team brings deep expertise in plan design, compliance and employee engagement.

In addition, if your organization doesn’t currently offer a QHDHP, we can help you evaluate your options and design a plan that aligns with your goals, budget and workforce needs. From strategic planning to implementation and employee education, USI is here to help you unlock the full potential of your benefits program.

Ready to explore your savings potential? Connect with your USI representative or fill out the form to request an analysis.

1 Tax savings presented here are illustrative only and do not reflect actual savings. Actual savings will be dependent on a number of factors, including member participation, actual contributions, and performance of nondiscrimination testing.

2 Based on 2026 federal maximums, assuming the employee maxes out single HSA, limited purpose FSA, dependent care FSA and transportation accounts.

3 Prudential, Why Employers Should Care About the Costs of Delayed Retirements, 2019.

4 Fidelity Viewpoints, September 2025.

5 Health Equity, Cutting benefit costs: How an HSA contribution match can be a game changer, February 2025.

This information is provided solely for educational purposes and is not to be construed as investment, legal or tax advice. Prior to acting on this information, we recommend that you seek independent advice specific to your situation from a qualified investment/legal/tax professional. | EB25.S1112.99030

SUBSCRIBE

Get USI insights delivered to your inbox monthly.