Retirement Consulting Insights

Beware of Investment Education Gimmicks

JUNE 6, 2023

If you are looking to offer one-on-one investment advice to your retirement plan participants, you’ll want to steer clear of advisors who may expose fiduciaries to increased risk from conflicts of interest. A knowledgeable and experienced retirement plan recordkeeper who provides financial wellness education to employees and investment advice to employers may be the best solution, and can help make personal guidance a highlighted feature of your retirement plan.

Employees Need More Than Advice

Employers have a responsibility to ensure the financial assistance provided to employees is appropriate. This creates several challenges, including:

- An advisor who may have a goal to sell other products or services to the employee.

- A lack of consistency in the advice provided.

- An advisor who may be less experienced, and therefore does not have the depth of knowledge needed to offer effective advice to employees.

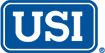

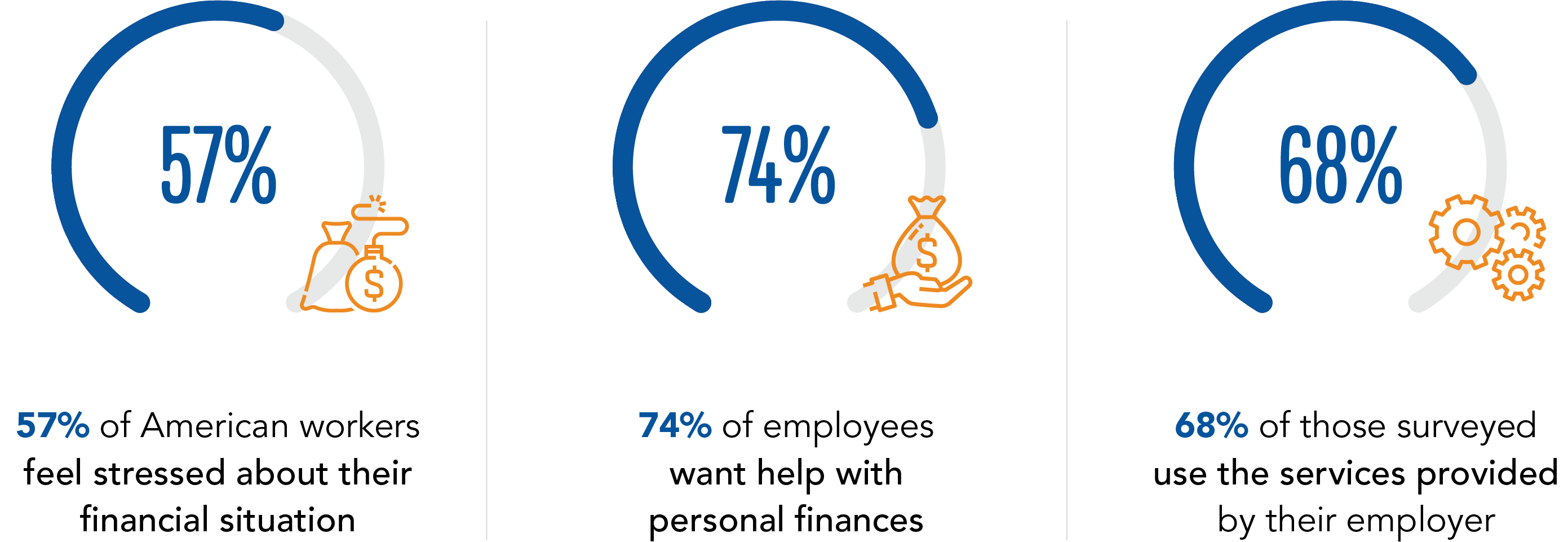

Many employees seeking help need financial wellness education, not just recommendations for their 401(k) account investments. In fact, a recent study1 indicates American workers are struggling and want assistance with personal finances:

Any guidance offered to employees should be a call to action, allowing each employee to work with their recordkeeper to update investment elections and/or request transfers from their retirement account online. If the advisor is unfamiliar with the recordkeeper’s website, or the employee experiences difficulties accessing their account during the one-on-one session, the worker may not follow through with the advisor’s suggested changes. It’s vital to select an advisor who understands recordkeeper capabilities and therefore can provide more than investment insight. This ensures employees receive the education and guidance they need to plan for a financially secure retirement.

Impartial and Consistent Guidance

USI Consulting Group (USICG) believes a retirement plan recordkeeper is best positioned to provide education to employees because:

- A significant portion of education is spent showing employees how to access and use available tools on the recordkeeper’s website.

- Employees will receive largely impartial feedback and results from modules that can be accessed on the website.

- Members of the recordkeeper’s team will provide consistent messaging to employees across in-person, over the phone, or online communications.

- Often, the employee seeking assistance is best served by investing in a target date fund or managed account. The recordkeeper’s website easily encourages employees to strongly consider those options.

- Recordkeepers provide robust online services geared around financial wellness education.

Holistic Approach

As a firm solely dedicated to employer-sponsored retirement plan (ESRP) consulting, USICG does not expose employers to potential conflicts of interest. Some advisors will actively seek to provide advisory services to an organization while also working with their employees on their individual wealth management needs. This diminishes the importance of working with all employees holistically, especially for advisors who do not specialize in ESRP consulting.

How USI Consulting Group Can Help

Learn more about USICG solutions and how financial wellness education plays a vital role in our recordkeeping services. Contact your USICG representative, visit our Contact Us page or reach out to us at information@usicg.com.

![]() Follow USICG on LinkedIn to stay up to date with retirement news!

Follow USICG on LinkedIn to stay up to date with retirement news!

1 PwC, 2023 Employee Financial Wellness Survey

2 Bank of America’s “Workplace Benefits Report”, 2022

Investment Advice provided by USI Advisors, Inc. Under certain arrangements, securities offered to the Plan through USI Securities, Inc. Member FINRA/SIPC. 95 Glastonbury Blvd. Suite 102 Glastonbury, CT 06033 860.652.3239 USI Consulting Group is an affiliate company of both USI Advisors, Inc. and USI Securities, Inc.

This information is provided solely for educational purposes and is not to be construed as investment, legal or tax advice. Prior to acting on this information, we recommend that you seek independent advice specific to your situation from a qualified investment/legal/tax professional. | 1023.S0523.0038

SUBSCRIBE

Get USI insights delivered to your inbox monthly.