Personal Risk Insights

Construction and Renovation Costs on the Rise: Address This Long-Term Impact of COVID-19

JULY 6, 2021

As the U.S. slowed to a halt in March 2020, no one anticipated the impact the pandemic would have on the lumber industry and the construction business.

Anticipating a Reduction in Demand … That Never Panned Out

In 2020, by the time the U.S. was in lockdown to slow the spread of the COVID-19 virus that would result in more than 4 million deaths globally (and counting), businesses were navigating unchartered waters to stay afloat. The lumber industry anticipated a significant reduction in demand for construction and renovation, and in an attempt to save its businesses, it took steps to reduce supply. Sawmills slowed production and unloaded inventory, expecting drops in demand similar to the Great Recession. But the reduced need never materialized.

Instead, during the lockdown, Americans sought to release pent-up energy and funds by renovating homes, recreation spaces and outdoor entertainment areas. The demand for construction material soared at the exact moment the industry slammed on the brakes. Record increases in the cost of materials would follow suit, with lumber costs estimated to have increased 300% to 400% from 2019.

Contending With the Impact of Catastrophic Events on Underwriting

Meanwhile, the insurance business was wrestling with a series of catastrophic events in 2020 including more than 30 named storms and 58,900 wildfires. In 2020, the U.S. saw an increase of 6 million acres of scorched earth from 2019. All of this activity has significantly impacted the profitability of property insurance underwriting. As a result, clients have been facing reduced capacity (supply), contraction in coverages, and premium increases that create additional stress for individuals and families on top of already existing COVID-19 burdens.

Now more than ever, it is critical to be diligent about the replacement cost terms and values on your home. The rise in lumber material alone is estimated to inflate the cost to rebuild a typical home by $36,000. Given the current market conditions, there is substantial risk that one’s home is underinsured. In states like California, Colorado, Texas and Florida, the change in intensity of storms and droughts have created conditions where “replacement cost coverage” for homes has been further restricted. As profitability of property insurance continues to erode, we will also see more reduction in coverage.

How Having Proper Coverage in Place Prevents Losses

In our personal risk assessments for clients, USI Insurance Services includes validation of the cost to rebuild a home and the broadest available term to rebuild your home. A USI client had relocated to a new state subject to catastrophic perils, purchasing a new-construction home in a planned community. As a result of USI’s risk assessment, the client purchased a homeowners policy at estimated cost of reconstruction with guaranteed replacement cost on the dwelling.

Six months after the move, the client suffered a complete loss of her home due to fire. Fortunately, the custom risk management plan created by USI provided enough protection to rebuild the home. Despite the home being less than a year old, the client was required to make upgrades to meet changes in the local code. The replacement cost coverage included increases for rebuilding to code that were essential to avoiding an additional out-of-pocket expense of $100,000 on a $1 million reconstruction cost.

How USI Can Help

We are living in a challenging environment, with demand far exceeding supply for lumber and other materials, shortages in labor, and a backlog of construction work that has grown despite a production ramp-up exceeding pre-COVID rates. This means higher costs for building, renovating, or repairing a home, with delays that could results in further charges. These cost spikes can put clients in a position where there is not enough coverage if there is a total loss.

To ensure your risk management program keeps pace with this new environment, take these key steps:

- Confirm that the current coverage limit for your home is adequate given the increase in cost for materials and labor.

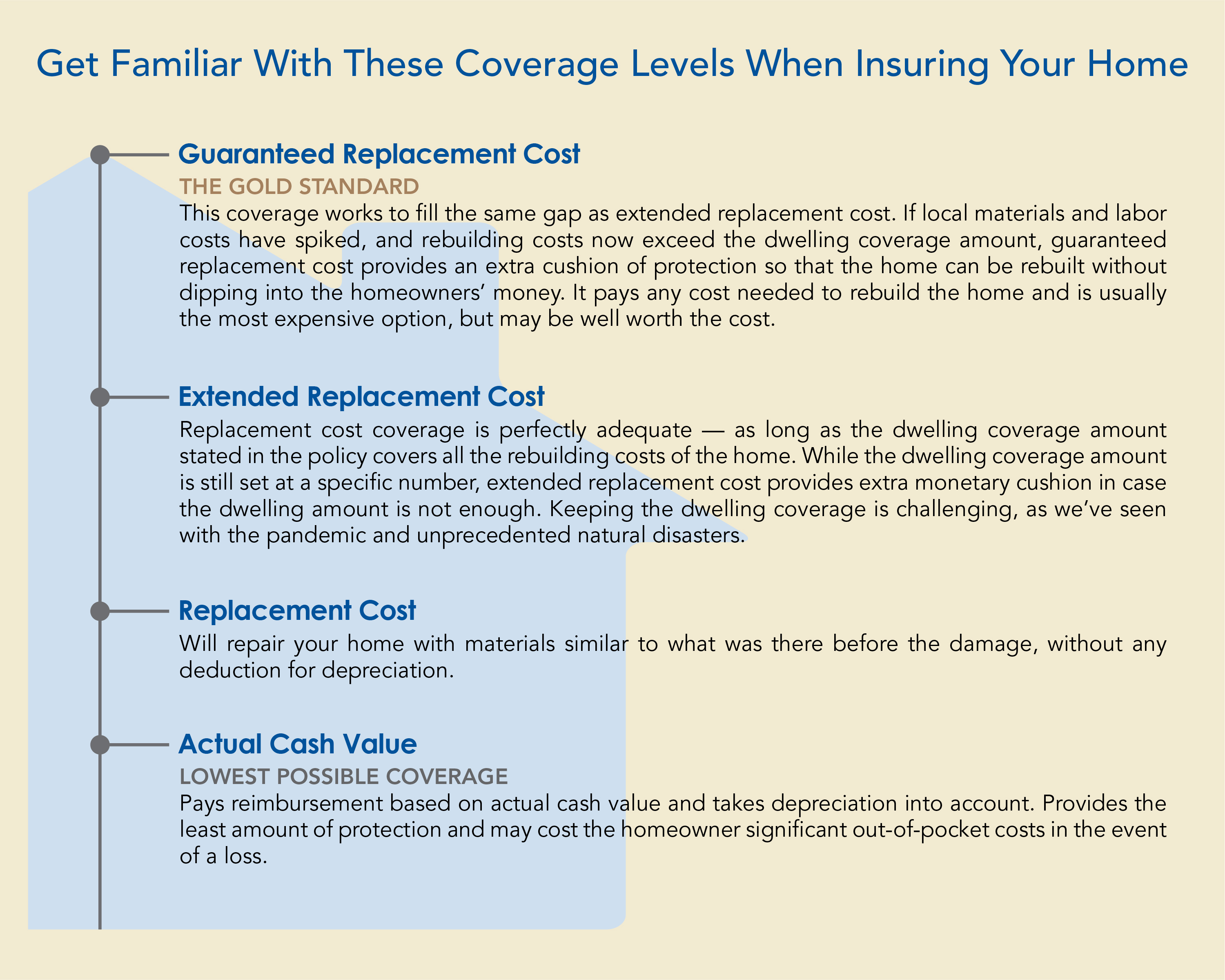

- Review your policy for replacement coverage. Confirm that your home is protected for full replacement cost, and that the policy language clearly defines what is included.

- Validate that the replacement cost coverage guarantees the cost to rebuild, or, to what additional percentage of the building value the policy extends the cost to replace.

Financial advisors have warned that the supply chain, labor and backlog issues are long-term challenges that need to be addressed. USI personal risk professionals are prepared to complete a comprehensive risk assessment including proper valuation of your home. Addressing known risk before catastrophe strikes is essential to any risk management plan.

For more information about properly insuring your home post pandemic, contact a USI personal risk advisor.

Sources:

https://fortune.com/2021/06/10/lumber-prices-2021-chart-price-of-lumberproduction-wood-supply-costs-update-june/

Ed Leefeldt and Amy Danise, “Why You Want Home Insurance With Extended Or Guaranteed Replacement Cost”, Forbes, 5/26/21, Forbes.com https://www.noaa.gov/news/2020-atlantic-hurricane-season-takes-infamous-top-spot-for-busiest-on-record

SUBSCRIBE

Get USI insights delivered to your inbox monthly.